NO.PZ2017102901000068

问题如下:

A company issues $30,000,000 face value of five-year bonds dated 1 January 2015 when the market interest rate on bonds of comparable risk and terms is 5%. The bonds pay 4% interest annually on 31 December. Based on the effective interest rate method, the carrying amount of the bonds on 31 December 2015 is closest to:

选项:

A.

$28,466,099.

B.

$28,800,000.

C.

$28,936,215.

解释:

C is correct.

N=5,I/Y=5,FV =$30,000,000.00,PMT= $1,200,000.00,→PV= $28,701,157.00

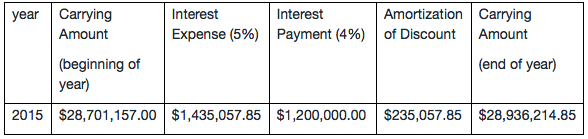

The following table illustrates interest expense, premium amortization, and carrying amount (amortized cost) for 2015.

Alternatively, the following illustrates the keystrokes for many financial calculators to calculate the carrying value at the end of first year of $28,936, 215:

N=4,I/Y=5,FV =$30,000,000.00,PMT= $1,200,000.00,→PV= 28,936, 215

只算出了第一步PV 然后就不会了,这道题考察的是什么知识点啊?