NO.PZ2019122802000003

问题如下:

An committee has historically used a traditional approach to define the opportunity set based on distinct macroeconomic regimes, and one analyst proposes that a risk-based approach might be a better method. Although the traditional approach is relatively powerful for its ability to handle liquidity and manager selection issues compared to a risk-based approach, there are a number of limitations associated with the existing approach. Which of the following limitation of the existing approach used by the committee to define the opportunity set?

选项:

A.is difficult to communicate.

B.overestimates the portfolio diversification.

C.is sensitive to the historical look-back period.

解释:

B is correct.

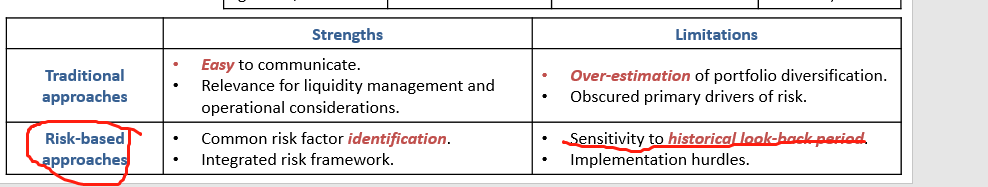

A traditional approach has been used to define the opportunity set based on different macroeconomic conditions. The primary limitations of traditional approaches are that they overestimate the portfolio diversification and obscure the primary drivers of risk.

这是defining oppotunity set 的知识点,即另类投资产品的投资类别分类,主要有两类分类方法一类就是traditional approach, 另外一类就是risk-based approach.

Traditional 是根据宏观的条件/流动性来看在何种条件下适合投资怎么样的产品,risk-based是根据回归的方法来定义资产类别的。

之所以说traditional approach会高估分散化的效果,是因为traditional approach只是形式上做到了分散化,但实际上不同的产品之间可能是有关联的,并没有做到实质上的分散化,比如股票和大宗商品之间,他们可能都会收到相同的利率,宏观经济的因素的影响。

Risk-based方法是从风险的最终来源角度来回归的,用各个因子把风险的敏感系数回归出来,既然是回归,那么就是基于历史数据,所以对于选择的time-period非常敏感,不同的time-period可能会导致不同的回归系数。这是risk-based approach的缺点。

C错在是risk fbased才是sensitive to the historical look-back period.

为啥risk-based才是sensitive to the historical look-back period.