NO.PZ2016012101000198

问题如下:

Fairmont Golf issued fixed rate debt when interest rates were 6 percent. Rates have since risen to 7 percent. Using only the carrying amount (based on historical cost) reported on the balance sheet to analyze the company’s financial position would most likely cause an analyst to:

选项:

A.overestimate Fairmont’s economic liabilities.

B.underestimate Fairmont’s economic liabilities.

C.underestimate Fairmont’s interest coverage ratio.

解释:

A is correct.

When interest rates rise, bonds decline in value. Thus, the carrying amount of the bonds being carried on the balance sheet is higher than the market value. The company could repurchase the bonds for less than the carrying amount, so the economic liabilities are overestimated. Because the bonds are issued at a fixed rate, there is no effect on interest coverage.

解析:公司发行了固定利率的公司债,发行时候的市场利率为6%。发行后市场利率上升到了7%。题目问,如果分析师仅基于债券的账面价值来分析公司的财务状况,会导致什么结果。

账面价值是基于债券的历史成本入账的,也就是基于发行时候的市场利率6%来进行的会计处理。而实际上发行之后市场利率上升了,说明债券的市场价格下降了。

AB两个选项都是在比较债券的账面价值和经济价值。相比其经济价值(实际的价值),账面价值是高估了。选项A正确,选项B不正确。

Interest coverage ratio=EBIT/interest expense,由于债券是固定利率债券,公司实际支付的interest expense不会受到市场利率的影响,因此interest coverage ratio不变,选项C不正确。

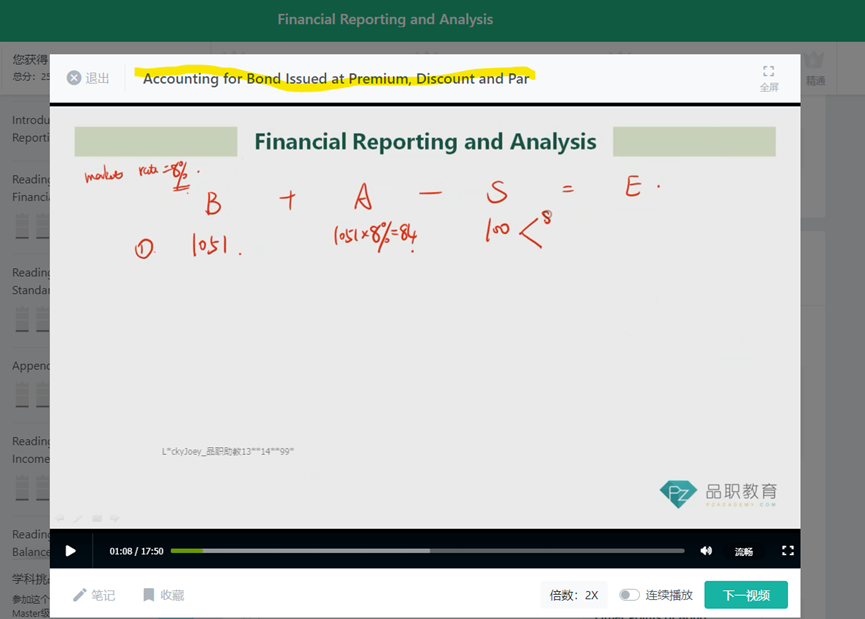

老师好,关于这道题如果按照BASE考虑:A=BV*利率,S不变,那最后在B/S中的E是6%比7%要小,所以6%下显示的负债被低估,选B。

这样理解的问题出在哪里呢?

谢谢。