NO.PZ2020033003000019

问题如下:

The following statements are about Merton model. Which one is correct?

选项:

A.

Merton model can be applied to value the firm with a variety of debts with different coupon rates and time-to-maturity.

B.

The Merton model assumes that firm value is lognormally distributed with a constant volatility.

C.

The firm value is allowed to jump from one value to another in the Merton model.D.

For high leverage firms, the Merton model predicts higher default probabilities and lower recovery rates, which is consistent with the reality.

解释:

B is correct.

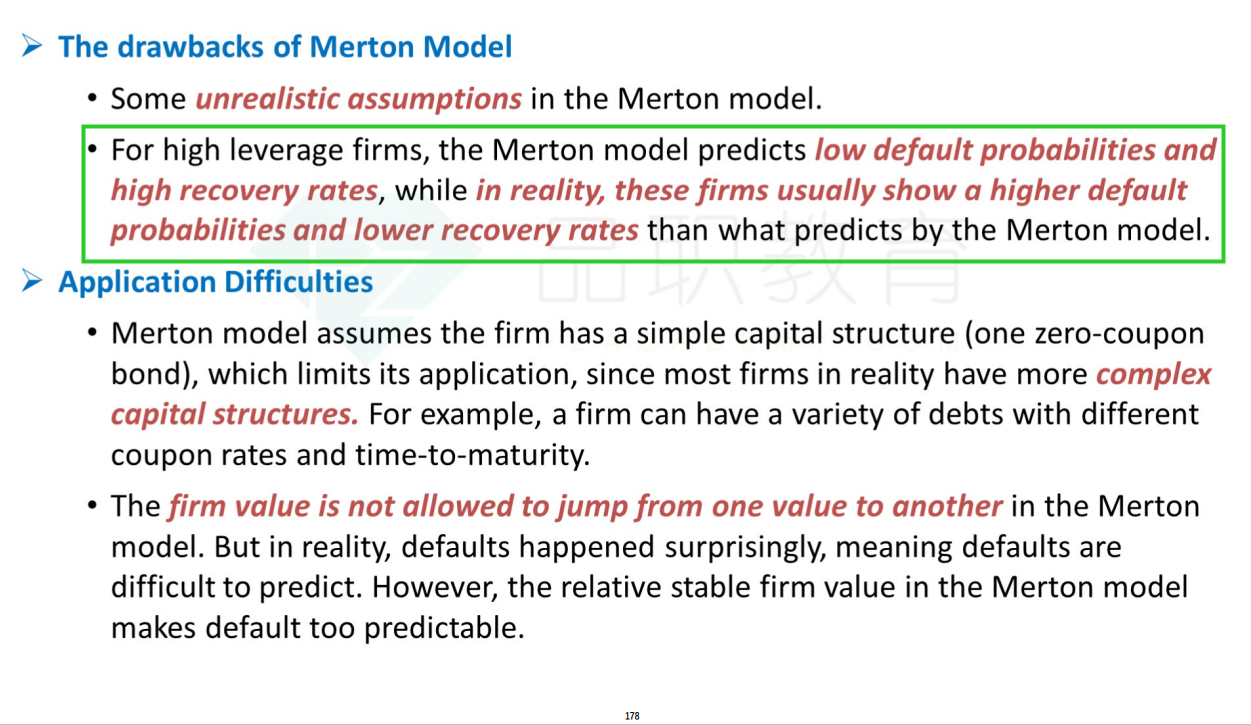

考点:Assumptions and Drawbacks of Merton Model

解析:选项A。Metron model 假设的是简单的资本结构。The firm has only one debt which is a zero- coupon bond with a face value of F and maturity of T.

选项B 正确。

选项C The firm value is not allowed to jump from one value to another in the Merton model.

选项D For high leverage firms, the Merton model predicts low default probabilities and high recovery rates,和现实正好相反。

d选项为啥merton模型估计出来是低风险高rr?