NO.PZ2016012102000152

问题如下:

When market interest rate is 6%, a company issues a $1 million bond with maturity of 3-year, a 5% coupon rate, and annual interest payments.

Which of the following statements is the most correct when the market rate changes to 7% and the carrying value of the bond base on amortized cost.

选项:

A.The book value of the bonds at the beginning of the Second year will be $990,566.04

B.The book value of the bonds at the beginning of the Second year will be $973,269.88

C.The book value of the bonds at the beginning of the Second year will be $981,666.07

解释:

C is correct.

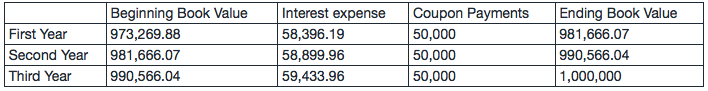

Since the amortized costs will not be affected by the change in market rates, we use 6% to calculate the beginning book value of the bond

N=3 I/Y=6 PMT=1,000,000×5%=50,000 FV=1,000,000 then CPT PV=973,269.88

The new book value= Beginning book value + interest expense -coupon rate=973,269.88+973,269.88×6%-50,000=981,666.07

The ending book value of First Year= the beginning book value of Second Year

考点:债券利息费用的计算

由于摊余成本(amortized costs ), 用的是发行时的市场利率(market interest rate ),不受后续市场利率变化的影响 ,所以我们采用6%计算该债券的期初账面价值.

N=3 I/Y=6 PMT=1,000,000×5%=50,000 FV=1,000,000

CPT PV = 973,269.88

第一年债券的现值,使用计算器计算得出973,269.88

后续每年的账面价值 = 初始债券账面价值 + 利息费用 - 支付的债券票面利息

利息费用 = 初始账面价值 * 债券发行时的市场利息率(market interest rate )

第二年债券账面价值 = 973,269.88 + 973,269.88×6% - 50,000 = 981,666.07

为什么计算bond的账面价值时候要加上用权责发生制下的interest expense,又要减去收付实现制的利息支出,死记硬背应付计算没问题,但是不理解这个原因,哪一讲有说这个原理吗,对应的讲义是哪一页,谢谢。