NO.PZ2016071602000013

问题如下:

The pension management analysts at Big Inc. use a two-step process to manage the assets and risk in the pension portfolio. First, they use a VAR-based risk budgeting process to determine the asset allocation across four broad asset classes. Then, within each asset class, they set a maximum tracking error allowance from a benchmark index and determine an active risk budget to distribute among individual managers. Assume the returns are all normally distributed. From the first step in the process, the following information is available.

Which of the following statements is/are correct?

I. Using VAR as the risk budgeting measure, the emerging markets class has the smallest risk budget.

II. If an additional dollar were added to the portfolio, the marginal impact on portfolio VAR would be greatest if it were invested in small caps.

III. As the maximum tracking error allowance is lowered, the individual managers have more freedom to achieve greater excess returns.

IV. Setting well-defined risk limits and closely monitoring risk levels guarantee that risk limits will not be exceeded.

选项:

A.I and II only

B.I,II,III,and IV

C.II and III

D.I only

解释:

A is correct. Risk budget is represented by the individual VAR, which is the smallest for emerging markets, so statement I. is correct. The marginal VAR is highest for small caps, so adding one dollar to that asset class would have the largest impact on the portfolio. Statement III. is incorrect, as lowering TEV would give less, not more freedom to manages. Finally, setting risk limits does not ensure they will not be exceeded. Bad luck and exceptions can happen, even if the risk model is correct.

No.PZ2016071602000013 (选择题)

来源: Handbook

The pension management analysts at Big Inc. use a two-step process to manage the assets and risk in the pension portfolio. First, they use a VAR-based risk budgeting process to determine the asset allocation across four broad asset classes. Then, within each asset class, they set a maximum tracking error allowance from a benchmark index and determine an active risk budget to distribute among individual managers. Assume the returns are all normally distributed. From the first step in the process, the following information is available.

Which of the following statements is/are correct?

I. Using VAR as the risk budgeting measure, the emerging markets class has the smallest risk budget.

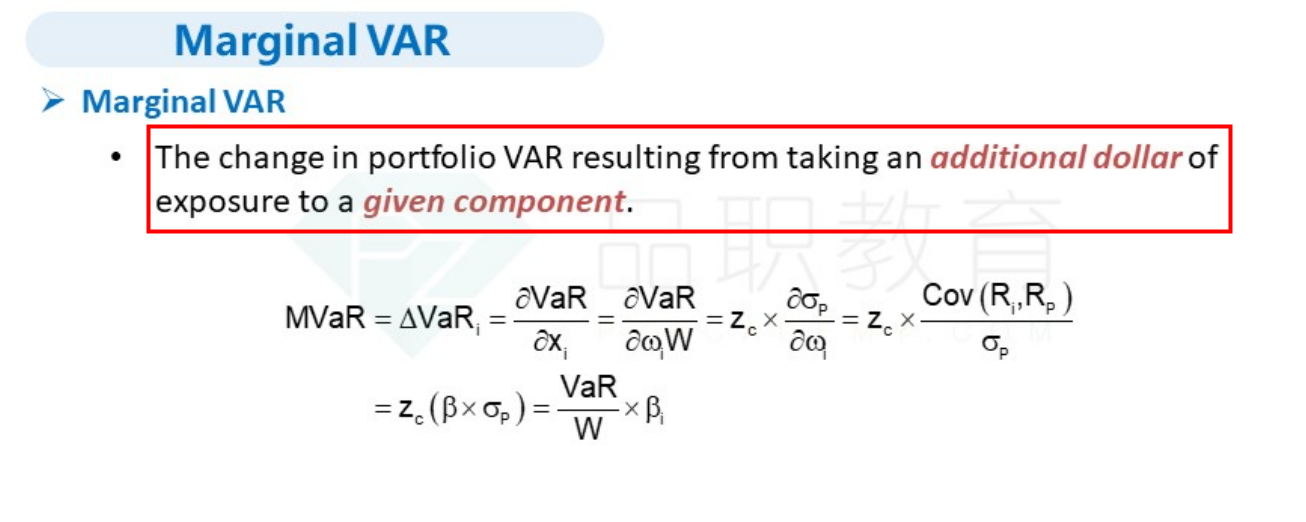

II. If an additional dollar were added to the portfolio, the marginal impact on portfolio VAR would be greatest if it were invested in small caps.

III. As the maximum tracking error allowance is lowered, the individual managers have more freedom to achieve greater excess returns.

IV. Setting well-defined risk limits and closely monitoring risk levels guarantee that risk limits will not be exceeded.

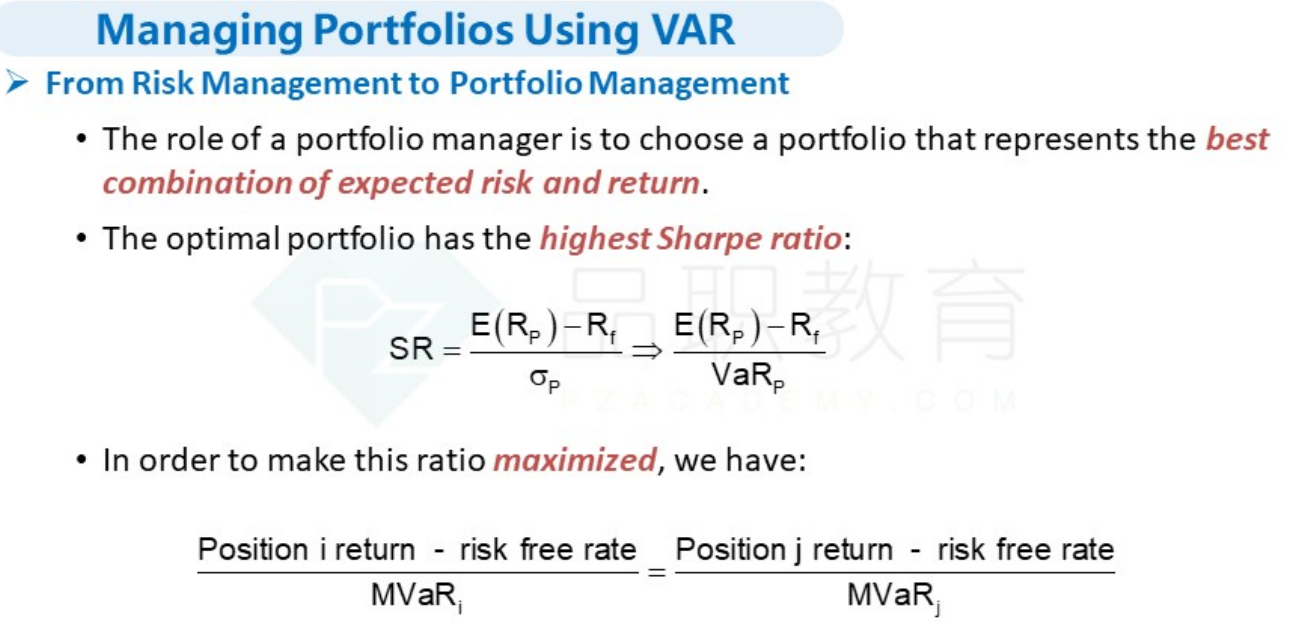

想问一下II,为什么没有把第一列expected return考虑进去呢。讲义上说increase position with higher sharpe ratio,rf是一致的,如果用expected return/MVaR,那么最大的应该是commodities