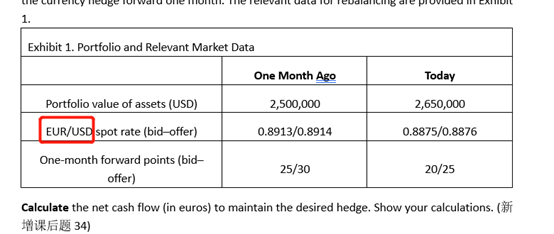

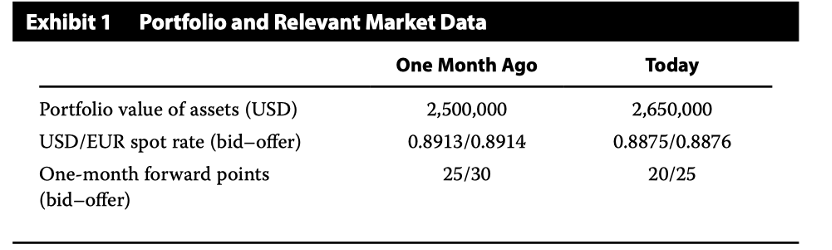

Assume Rivera’s portfolio was perfectly hedged. It is now time to rebalance the portfolio and roll the currency hedge forward one month. ‑e relevant data for rebalancing are provided in Exhibit 1.

Calculate the net cash flow (in euros) to maintain the desired hedge. Show your calculations.

答案:

When hedging one month ago, Delgado would have sold USD2,500,000 one month forward against the euro. Now, with the US dollar-denominated portfolio increasing in value to USD2,650,000, a mismatched FX swap is needed to settle the initial expiring forward contract and establish a new hedge given the higher market value of the US dollar-denominated portfolio.

To calculate the net cash flow (in euros) to maintain the desired hedge, the following steps are necessary:

Buy USD2,500,000 at the spot rate. Buying US dollars against the euro means selling euros, which is the base currency in the USD/EUR spot rate. Therefore, the bid side of the market must be used to calculate the outflow in euros.

USD2,500,000 × 0.8875 = EUR2,218,750.

这里是不是错了?应该是2500000/0.8875

这里不是吧 USD转换为EUR吗?

Sell USD2,650,000 at the spot rate adjusted for the one-month forward points (all-in forward rate). Selling the US dollar against the euro means buying euros, which is the base currency in the USD/EUR spot rate. Therefore, the offer side of the market must be used to calculate the inflow in euros.

All-in forward rate = 0.8876 + (25/10,000) = 0.8901.

USD2,650,000 × 0.8901 = EUR2,358,765.

Therefore, the net cash flow is equal to EUR2,358,765 – EUR2,218,750, which is equal to EUR140,015.