Omega Financial, a large financial services firm, makes a market in more than 500 stocks. As a market maker, the firm executes institutional orders as well as retail orders placed by its private wealth unit, its broker/dealer affiliate, and other third-party broker/dealers.

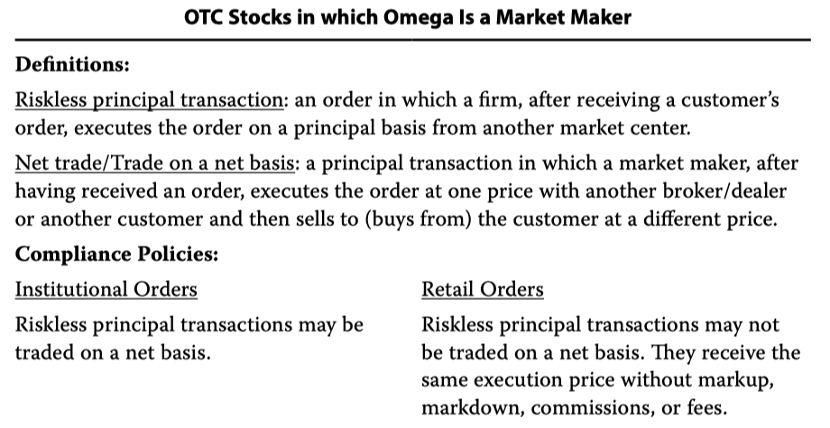

A page in Omega’s compliance manual, which adhere to all legal and regulatory requirements, includes the following information:

Consistent with regulatory requirements, Omega discloses the information about riskless principal transactions to all clients and third-party broker/dealers. In addition, Omega informs third-party broker/dealers that it will seek best execution on retail orders.

Omega is developing an automated order-handling system to improve efficiencies in order flow. Anticipated benefits of the new system include much faster execution speeds. Additionally, the system design includes a trading mechanism that will execute portions of certain large orders to reduce market impact. ‑e trading mechanism delays some orders to allow the firm to obtain a better overall price.

Xavier Brown, CFA, is responsible for overseeing the project to ensure its timely completion. Brown enlists the compliance department to review the programming during the initial development phase and identify any potential problems. ‑e compliance department compares the order-handling function of the new system to the third-party software currently in use. ‑ey identify several potential problems, including delays in execution of certain large market orders and embedded markups and markdowns on stocks in which the firm makes a market. According to the compliance department, changes are necessary to comply with regulatory requirements.

Brown directs the programmers to correct the problems and run tests and simulations. ‑e programmers spend the next few months making changes to the system and adding comments throughout the code that clearly explain the purpose of particular functions. After several months, the programmers report that they have corrected all the identified problems and run the necessary tests and simulations. ‑e following month, the firm switches to the automated order-handling system as planned.

Joy Chen, CFA, trades Xydeo stock for Omega. One month following the switch to the new order-handling system, Chen is able to execute a number of principal riskless transactions for both institutional and retail clients at $25.00 per share. When processing the customer buy orders totaling 500,000 shares, the new system automatically uses the best-publicized price of $25.01, and then the firm issues client confirmations showing a purchase price of $25.01.

Stephen Smith, CFA, works across from Chen on the trading desk at Omega. His seat is close to a speaker for the company’s squawk box, which is used to broadcast information about current analyst recommendations, news about market events, and information about pending block trades.

Smith’s young brother-in-law, Adolfo Garcia, recently accepted a position as a broker at a third-party broker/dealer that trades with Omega. Garcia has a modest income and little savings. He is enthusiastic about investments and has enrolled as a CFA candidate. Smith calls Garcia early each morning to talk about the previous day’s events. At the end of their conversation, Smith places the call on speakerphone and resumes his work.

In his office, Garcia can hear Omega’s squawk box over the speakerphone. Garcia enjoys listening as Omega analysts discuss changes in ratings, economic forecasts, and capital market developments. He is careful not to trade in stocks mentioned explicitly on the squawk box. Rather, he sometimes researches competitors and other firms operating in the same industry. In one case, he immediately shorts the stock of Tefla Corporation after an Omega analyst downgrades a firm in the same industry.

Garcia frequently places large block orders for low-priced, small-capitalization stocks at the market price. Once the new system is operational, Smith processes the orders through the new trading system mechanism, which delays execution of portions of the orders and allows the firm to obtain a better price for Garcia.

With regard to Chen’s trades in Xydeo, do the institutional and retail trades both comply with the CFA Institute Standards?

A Only the retail trades comply.

B Only the institutional trades comply.

C Neither the retail nor the institutional trades comply.

答案:B

这个题目为什么选B

When listening to the Omega squawk box, does Garcia violate any of the CFA Institute Standards?

A No

B Yes, the standard regarding professionalism

C Yes, the standard regarding material nonpublic information

B

为什么不选C

尽管他没有直接去short听到的股票,但是他short了同行业的股票,为什么不算内幕信息交易?他确实利用了听到的内幕消息。