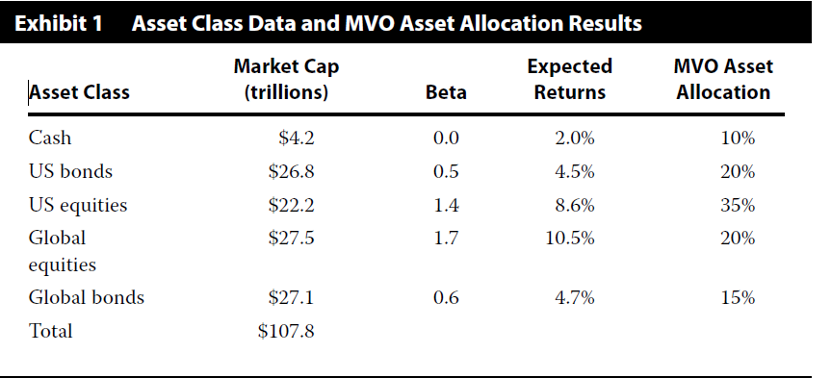

Walker Patel is a portfolio manager at an investment management firm. After successfully implementing mean–variance optimization (MVO), he wants to apply reverse optimization to his portfolio. For each asset class in the portfolio, Patel obtains market capitalization data, betas computed relative to a global market portfolio, and expected returns. This information, along with the MVO asset allocation results, are presented in Exhibit 1.

The risk-free rate is 2.0%, and the global market risk premium is 5.5%.

Contrast, using the information provided above, the results of a reverse optimization approach with that of the MVO approach for each of the following:

i. The asset allocation mix

ii. The values of the expected returns for US equities and global bonds

Justify your response.

答案:Return on Global Bonds = 2.0% + (0.6) (5.5%) = 5.3%

Return on US Equities = 2.0% + (1.4) (5.5%) = 9.7%

为什么不是用(expected return-rf)来计算premium?

Return on Global Bonds = 2.0% + (0.6) (8.6%-2%) = 5.3%这不也是市场的观点吗