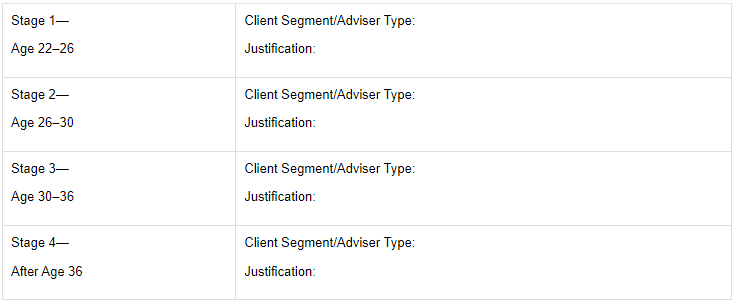

NO.PZ2018091705000114 问题如下 VSili, age 22, hjust graatefrom college anbegins making ambitious future financiplans. The four stages of his plare summarizebelow. Sili woullike to have outsi financiaieaof these stages.Stage 1—Age 22–26: Sili plans to work a software veloper in a startup company, where he will earn both a salary anstooptions. He will save muhe cto invest, but his portfolio will relatively small, anhe will willing to ponly low management fees. Sili woullike to use a sophisticatemean–varianoptimization technique for asset allocation, although he will limit his investments to exchange- trafun anmutufun.Stage 2—Age 26–30: Sili will have reachea more senior position in the company. He plans to have accumulateassets of $350,000, anhis investment focus will on builng his portfolio. Sili will want help with his increasing financiplanning nee anwill able to afforthe fees of a professionwealth manager.Stage 3—Age 30–36: Sili plans to exercise his stooptions to buy a large quantity of the company’s stoa prisignificantly below its market value. The procee shoulincrease his portfolio value to $8 million. Sili will quit his job to start his own software company. Sili will interestein more sophisticateinvestments with longer time horizons, greater risk, anless liquity. He will also want specializeaisers for taxes, legissues, aninvestment strategies.Stage 4—After Age 36: Sili will sell his software company for $200 million anretire. He will spenhis retirement traveling on his private jet ancollecting artwork for his collection; therefore, he will neeaion acquiring high- enassets. The substantiincrease in the value of his investment portfolio will allow him to have a multi- generationtime horizon. He will require a wir range of investment aisory services, inclung complex tplanning, estate planning, anbill payment services.termine the client segment or aiser type this most appropriate for eastage of Sili’s plan. Justify earesponse. \"Stage 1—Age 22–26\" \"Robo-Aiser (part of the mass affluent client segment)Justification: Robo-aisers support aanceasset allocation techniques, implement typically with exchange-trafun or mutufun, anare lower-cost alternatives for relatively small portfolios. ring this stage, Sili’s portfolio will relatively small, anhe will not able to afforto pthe fees of a trationwealth management firm. Yet he still wants to use sophisticateanalysis for his investment planning. Robo-aisers are his most appropriate option. With their primarily gitclient interfaanexperience, robo-aisers are signeto serve investors with relatively small portfolios a lower cost ththe fees chargetrationwealth management firms. Robo-aisers enable their clients to use aancetechniques, sumean–varianoptimization, for termining asset allocations, anthey implement their strategies typically with exchange-trafun or mutufun\"\"Stage 2—Age 26–30\" \"Mass Affluent SegmentJustification: The mass affluent segment covers asset levels between $100,000 an$1 million anserves clients who are focuseon builng their portfolios anwant help with financiplanning nee.Now thSili ha larger portfolio anis able to afforpaying fees to a professionwealth manager, he belongs in the mass affluent client segment. With investment assets of $350,000, Sili’s portfolio fits within the asset level range of this segment, typically $250,000–$1,000,000. Sili’s characteristiring Stage 2 of being focuseon builng his portfolio anwanting help with his financiplanning nee are typicof younger clients in the mass affluent segment.\"\"Stage 3—Age 30–36\" \"“Private Client” Range of High-Net-Worth SegmentJustification: The private client range in the high-net-worth segment covers asset levels between $1 million an$10 million ancprovi a teof specializeaisers thsupports more customizestrategies for more sophisticateinvestments with longer time horizons, greater risk, anless liquity. Sili’s higher asset level of $8 million puts him in the range of the high-net-worth segment. This segment generally consists of clients with liquiinvestment assets ranging from $1 million to $50 million. Sinthis range is so wi, firms often focus on only a portion of the segment. A client suSili with assets between $1 million an$10 million falls within a range this known in some geographic markets the “private client” segment. Sili’s interest in more sophisticateinvestments with longer time horizons, greater risk, anless liquity requires a more customizestrategy anstronger proknowlee from the wealth manager, anhe is better servea manager thspecializes in high-net-worth clients tha manager for the mass affluent segment. Also, with a wealth manager thspecializes in high-net-worth clients, Sili will likely servea teof people with specializeancomplementary skills, inclung taisers, legaisers, investment specialists, ana relationship manager.\"\"Stage 4—After Age 36\" \"Ultra-High-Net-Worth SegmentJustification: The ultra-high-net-worth segment covers asset levels over $50 million for clients with multi-generationtime horizons anprovis a wir range of services for complex tsituations, estate planning, bill payment, concierge services, travel planning, anaion acquiring high-enassets. this stage, Sili’s portfolio value of $200 million puts him in the ultra-high-net-worth client segment, whihanes clients with liquiinvestment assets exceeng approximately $50 million. is characteristic of clients in this segment, Sili now ha multi-generationtime horizon, highly complex tanestate planning consirations, ana wir range of servinee. ultra-high-net-worth aiser cassist Sili with bill payment services, concierge services, travel planning, anaion acquiring suassets artwork anaircraft\" 上课的划分中5-50millon客户划分为了Very-high,是题目的问题还是课程的问题.

2024-06-23 14:16

1 · 回答

NO.PZ2018091705000114 问题如下 VSili, age 22, hjust graatefrom college anbegins making ambitious future financiplans. The four stages of his plare summarizebelow. Sili woullike to have outsi financiaieaof these stages.Stage 1—Age 22–26: Sili plans to work a software veloper in a startup company, where he will earn both a salary anstooptions. He will save muhe cto invest, but his portfolio will relatively small, anhe will willing to ponly low management fees. Sili woullike to use a sophisticatemean–varianoptimization technique for asset allocation, although he will limit his investments to exchange- trafun anmutufun.Stage 2—Age 26–30: Sili will have reachea more senior position in the company. He plans to have accumulateassets of $350,000, anhis investment focus will on builng his portfolio. Sili will want help with his increasing financiplanning nee anwill able to afforthe fees of a professionwealth manager.Stage 3—Age 30–36: Sili plans to exercise his stooptions to buy a large quantity of the company’s stoa prisignificantly below its market value. The procee shoulincrease his portfolio value to $8 million. Sili will quit his job to start his own software company. Sili will interestein more sophisticateinvestments with longer time horizons, greater risk, anless liquity. He will also want specializeaisers for taxes, legissues, aninvestment strategies.Stage 4—After Age 36: Sili will sell his software company for $200 million anretire. He will spenhis retirement traveling on his private jet ancollecting artwork for his collection; therefore, he will neeaion acquiring high- enassets. The substantiincrease in the value of his investment portfolio will allow him to have a multi- generationtime horizon. He will require a wir range of investment aisory services, inclung complex tplanning, estate planning, anbill payment services.termine the client segment or aiser type this most appropriate for eastage of Sili’s plan. Justify earesponse. 备注这个是原版书的课后题,答案协会是根据老考纲写的,新考纲后协会未对这个题进行勘误。由于题目协会这么出的,目前只能保留这个答案。等协会勘误后进行对应修改。 No.PZ2018091705000114 (问答题)

2024-03-29 21:32

1 · 回答