NO.PZ2019070101000105

问题如下:

Which is the primary advantage of the option-adjusted

spread (OAS) over the static spread?

选项:

A.OAS uses the entire term structure instead of a single

point

OAS, being a valuation model, is not biased by the

market price of the bond

OAS allows for cash flow changes due to interest rate

changes

None, they are the same

解释:

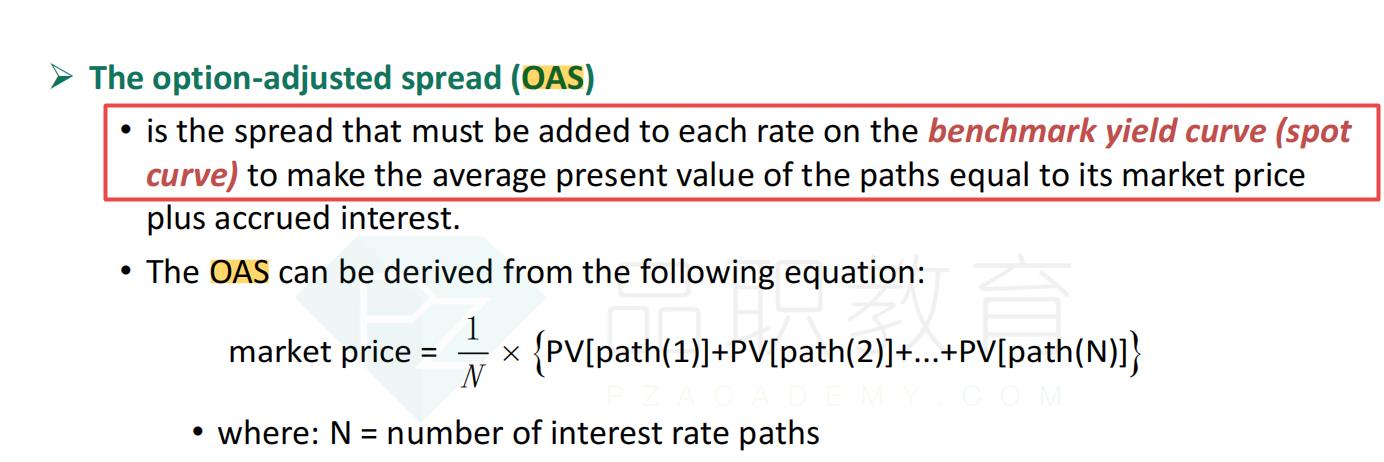

This is the key idea: while static (Z) spread treats

the term structure of rates as static, the OAS simulates several interest rate

paths and therefore can model cash flow changes. In regard to (A), this is not

correct because both OAS and static spread use the entire term structure. In

regard to (B), this is false: OAS solves for yield that equates to market

price.

C不太理解,请解释一下,谢谢