NO.PZ2018062004000147

问题如下:

The inventory of company M experienced a write-down in 2013, but the write-down was then reversed in 2014. Compared with the condition that the write-down never happened, which of the following is not true about company M's 2014 financial report? ?

选项:

A.

Cash flow from operations was higher.

B.

2014's ending inventory balance was unchanged.

C.

Profit was overestimated.

解释:

A is correct. The write-down indicates that the value of inventory decreased and the cost of sales increased, the reversal of the write-down indicates that the cost of sales decreased, so in 2014 the profits were overestimated. Because the write-down and reversal of the write-down offset each other, 2014' s ending inventory balance remained unchanged. Although the write-down and reversal of inventory did not influence the cash flow from operations, overestimated profits in 2014 tended to produce higher taxes, which led to lower cash flow from operations.

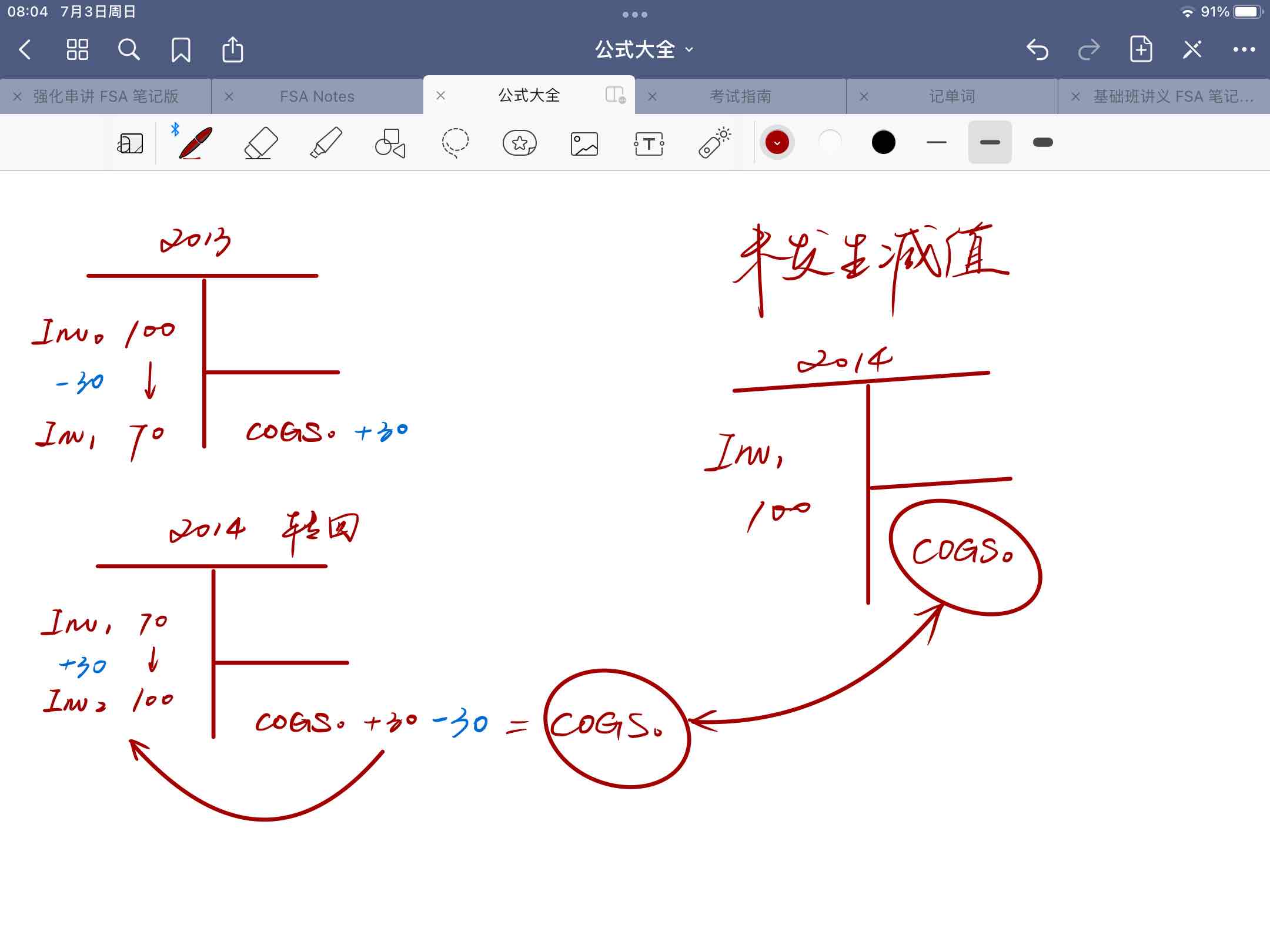

如图,我的理解是如果inventory不变,那么COGS 也没变,当然前提是没有发生其他导致存货变动的情况。不知道错在哪里。