NO.PZ2022052301000017

问题如下:

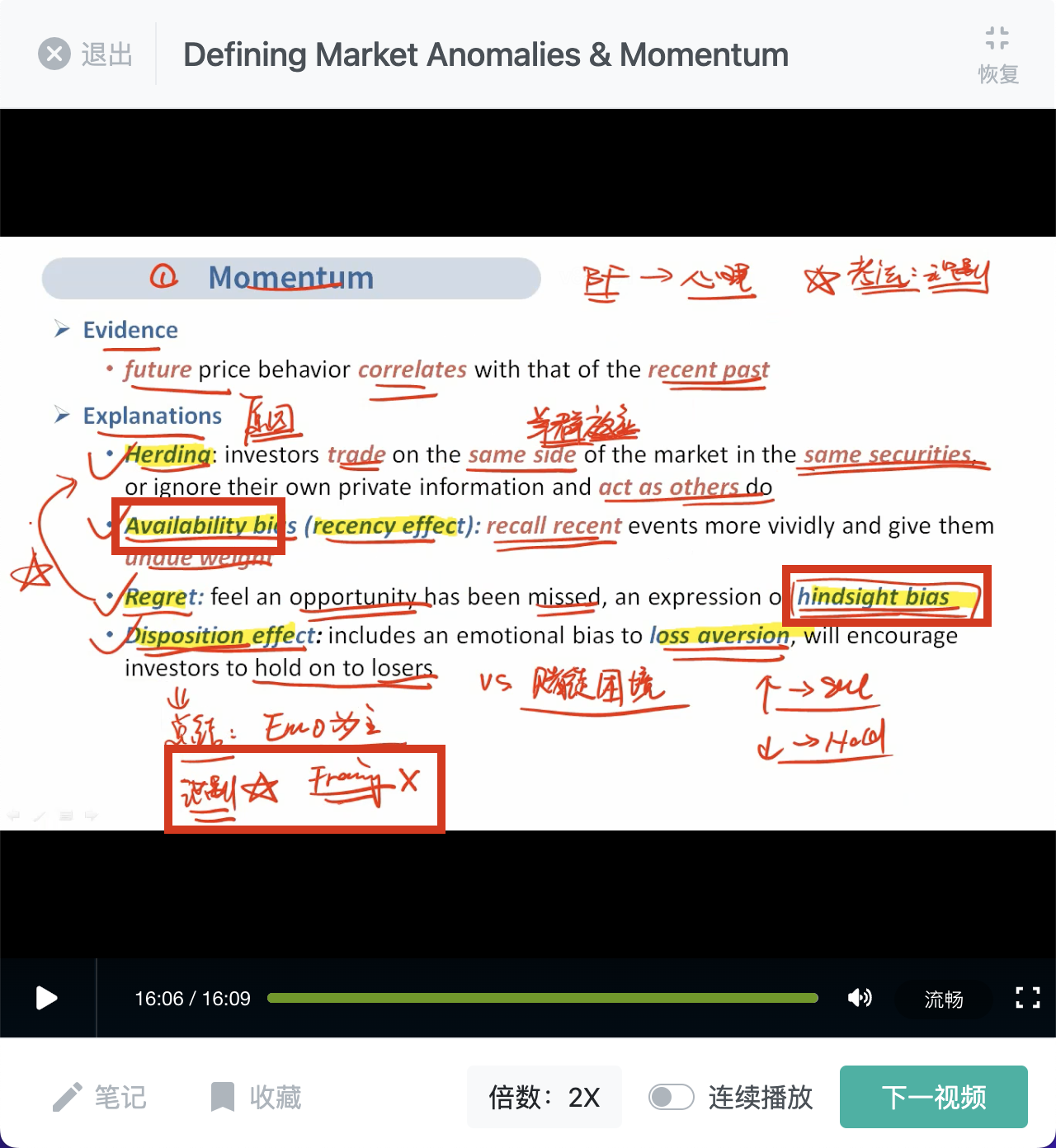

The CIO then suggests updating their stock selection model to incorporate a price momentum factor. Kelly states that she is concerned that momentum will not be effective across all sectors. The CIO counters that because a number of behavioral biases support the persistence of price momentum, they would be foolish not to incorporate this factor. After a brief discussion, the other committee members agree with the CIO and momentum is added to the stock selection model.

Which of the following biases least likely provides behavioral support for the factor being added to the stock selection model?

选项:

A.Framing

Availability

Hindsight

解释:

Framing bias is a type of cognitive error in which a person answers a question differently based on the way in which it is asked. This behavior is unlikely to explain the persistence of momentum. Regret is a type of hindsight bias that can result in investors purchasing securities after a significant run-up in price because of a fear of not participating. This bias could explain momentum. With availability bias, also referred to as the recency effect, the tendency to recall recent events more vividly can result in investors extrapolating recent price gains into the future. This bias could also explain momentum.

Hindsight也属于cognitive bias,这题答案是否有问题?