NO.PZ2020033002000006

问题如下:

There is a bond portfolio consisted with two bonds. bond A and bond B .The values of bond A and bond B are $60 millions and $40 millions respectively. The one-year probabilities of default and the recovery rate of bond A are 5% and 60% respectively, while for bond B are 7% and 50%. Calculate the one-year expected credit loss of this portfolio. Give an assumption that the defalut between A and B is independent.

选项:

A.

$1,200,000

B.

$1,400,000

C.

$2,600,000

D.

$3,200,000

解释:

C is correct.

考点: Credit VaR

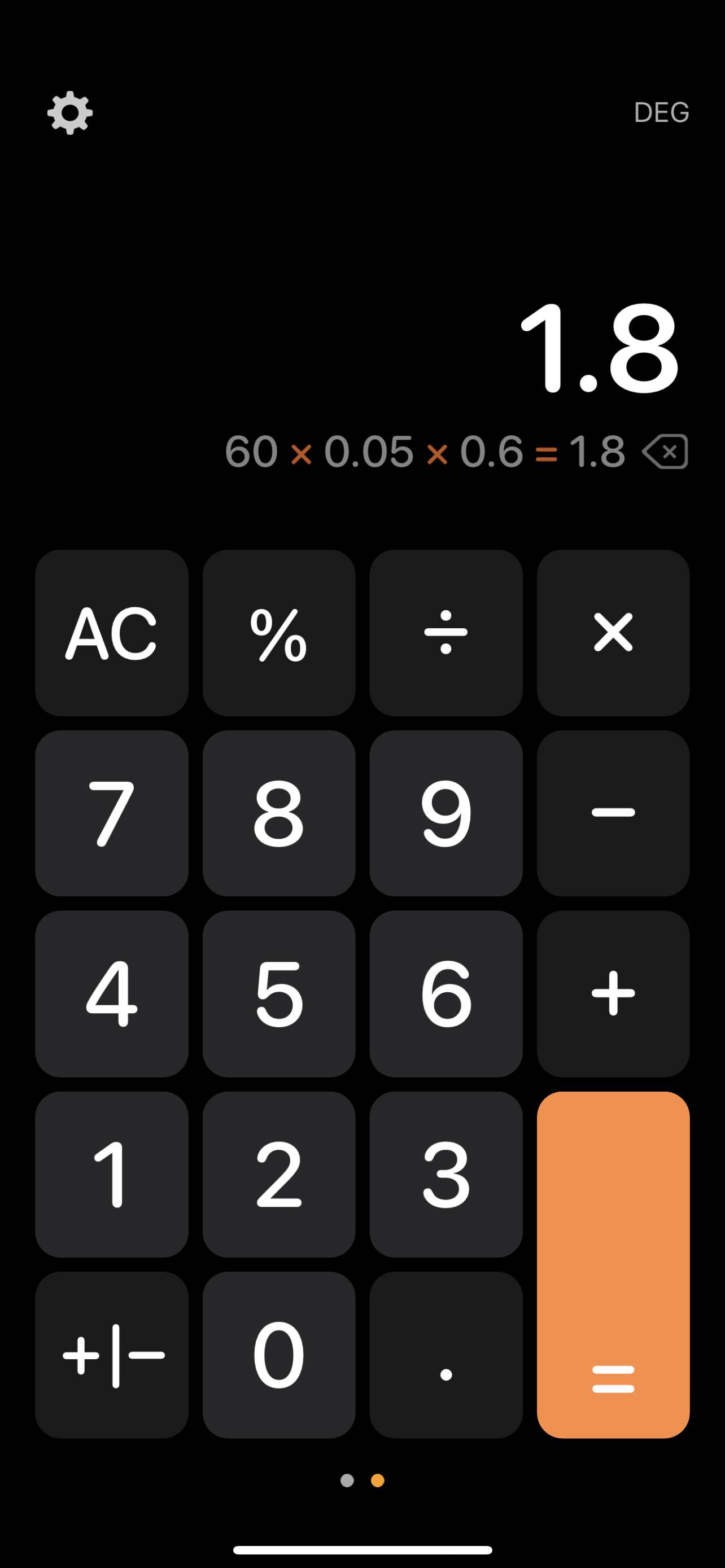

计算: EL(A)=60*0.05*(1-0.4)=1.2m

EL(B)=40*0.07*(1-0.5)=1.4m

1.2+1.4=2.6m

第一个el 我算错了吗