2016 Mock 下午题 Q16 Rioja’s case

(1)老师能否分别判断一下文中对以下四个概念的statment是否正确?如果错误,分别错在哪里?

<1>Effective Duration

<2>Convexity

<3>Key rate Duration

<4>Speard Duration

(2)对于Key rate Duration,为什么说“ relative attractiveness of various portfolio strategies, such as bullet strategies versus barbell strategies”?这句话有点不理解。什么是“relative attractiveness”?

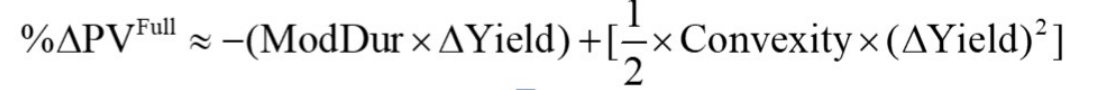

(3)我理解,对于Convexity,由于“涨多跌少”的特性,可以使得ΔP更接近真实值,为什么convexity的statement不对?

原题:

Rioja then asks Priorat, “I would like to understand the risk profile of each index benchmark we have assigned to the portfolio managers. What measures are available to do this?” Priorat responds,

There are several key measures that come to mind. Effective duration measures the sensitivity of the index’s price to a relatively small parallel shift in interest rates. For large non-parallel changes in interest rates, a convexity adjustment is used to improve the accuracy of the index’s estimated price change. Key rate duration measures the effect of shifts in key points along the yield curve. Key rate durations are particularly useful for determining the relative attractiveness of various portfolio strategies, such as bullet strategies versus barbell strategies. Spread duration describes how a non-Treasury security’s price will change as a result of the widening or narrowing of the spread contribution.