NO.PZ2018120301000032

问题如下:

Doug,

the newly hired chief financial officer for the City of Radford, asks the

deputy financial manager, Hui, to prepare an analysis of the current

investment portfolio and the city’s current and future obligations. The city

has multiple liabilities of different amounts and maturities relating to the

pension fund, infrastructure repairs, and various other obligations.

Hui

observes that the current fixed-income portfolio is structured to match the

duration of each liability. Previously, this structure caused the city to

access a line of credit for temporary mismatches resulting from changes in the

term structure of interest rates.

Doug asks Hui for different strategies to manage the interest rate risk of the city’s fixed-income investment portfolio against one-time shifts in the yield curve. Hui considers two different strategies:

An

upward shift in the yield curve on Strategy 2 will most likely result in the:

选项:

A.price effect cancelling the coupon reinvestment effect.

B.price effect being greater than the coupon reinvestment effect.

C.Coupon reinvestment effect being greater than the price effect.

解释:

Correct Answer: A

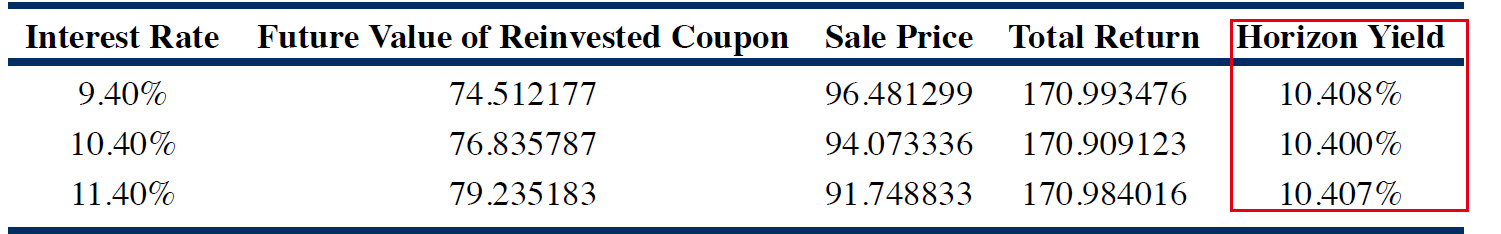

A is correct. An upward shift in the yield curve reduces the bond’s value but increases the reinvestment rate, with these two effects offsetting one another. The price effect and the coupon reinvestment effect cancel each other out in the case of an upward shift in the yield curve for an immunized liability.

老师,怎么从题目中看到price decrease 和reinvestment 会Offset呢?为什么变动一次还可以Immunization,rate再变一次就不行了呢? 谢谢