NO.PZ201809170400000605

问题如下:

Based on Exhibits 2 and 3, which portfolio best exhibits the risk characteristics of a well-constructed portfolio?

选项:

A.

Portfolio X

B.

Portfolio Y

C.

Portfolio Z

解释:

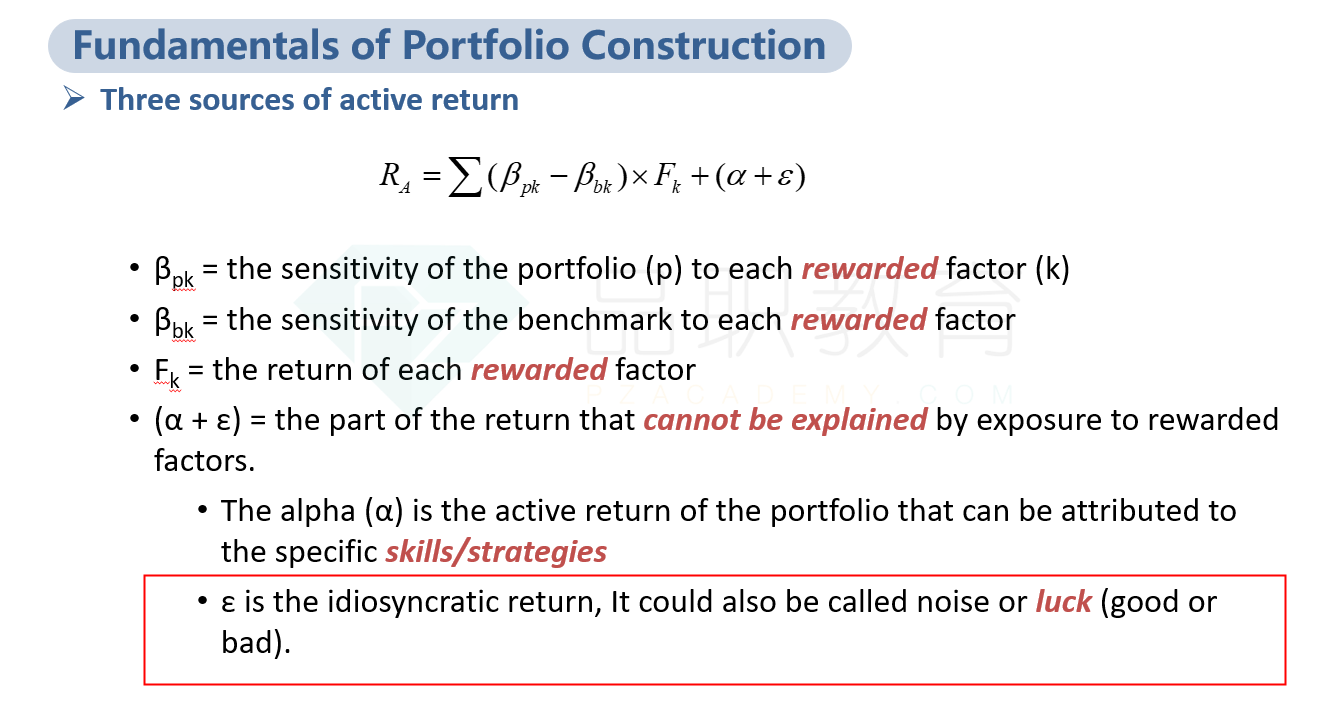

A is correct. Well-constructed portfolios should have low idiosyncratic (unexplained) risk relative to total risk. Portfolio Y exhibits extremely high unexplained risk relative to total risk, and Portfolios X and Z have low unexplained risk relative to total risk. Therefore, Portfolio Y may be eliminated.

Portfolios X and Z have comparable factor exposures. In comparing portfolios with comparable factor exposures, the portfolio with lower absolute volatility and lower active risk will likely be preferred, assuming similar costs. Portfolio X has lower absolute volatility and lower active risk than Portfolio Z, although both have similar costs.

Finally, for managers with similar costs, fees, and alpha skills, if two products have similar active and absolute risks, the portfolio having a higher active share is preferred. Portfolio X has lower absolute volatility, lower active risk, and higher active share than Portfolio Z. As a result, Portfolio X best exhibits the risk characteristics of a well-constructed portfolio.

idiosyncratic risk对应题目中的哪个risk? volatility还是active risk?