NO.PZ201712110200000401

问题如下:

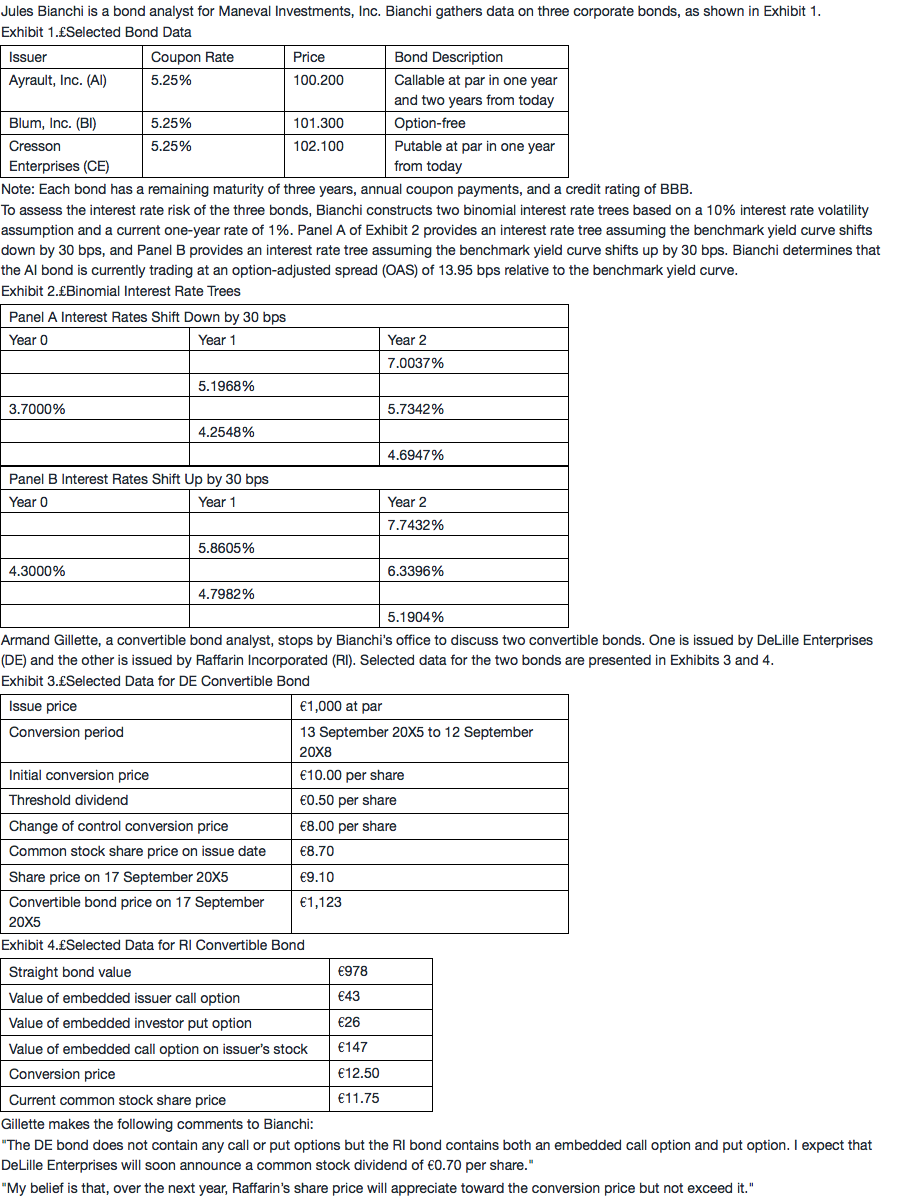

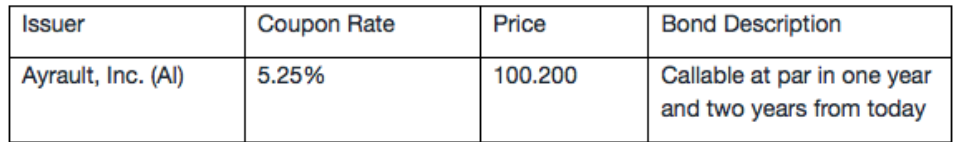

Based on Exhibits 1 and 2, the effective duration for the AI bond is closest to:

选项:

A.1.98.

B.2.15.

C.2.73.

解释:

B is correct.

The AI bond’s value if interest rates shift down by 30 bps (PV–) is 100.78. The AI bond’s value if interest rates shift up by 30 bps (PV+) is 99.487.

Effective duration=[(PV-)-(PV+)]/[2× (ΔCurve) × (PV0)]= (100.780 - 99.487)/ (2 × 0.003 × 100.200)=2.15

每个点加上13.95bp,可以得到

[0.5*(100+100)+5.25]/1.071432=98.2330

[0.5*(100+100)+5.25]/1.058737=99.4109

[0.5*(100+100)+4.8342]/1.048342=100

[0.5*(98.233+99.4109)+5.25]/1.053363=98.7997

[0.5*(99.4109+100)+4.3943]/1.043943=99.7178

PV0=[0.5*(98.7997+99.7178)+3.8395]/1.038395=99.2862

计算结果与答案不同?

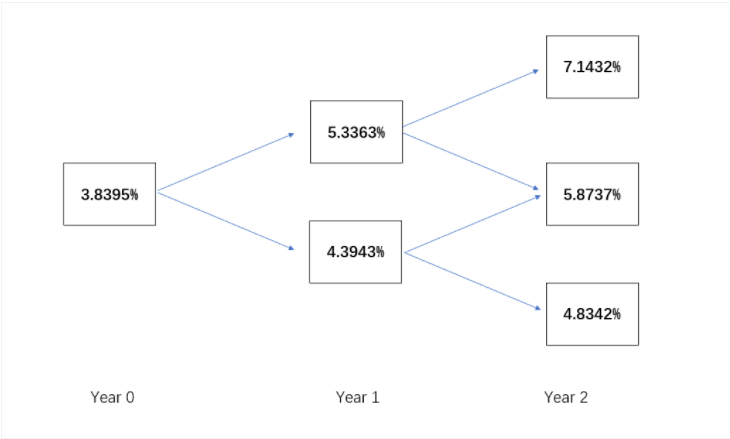

每个点加上13.95bp,可以得到

Year 0 Year 1 Year 2

4.4395% 6% 7.8827%

4.9377% 6.4791%

5.3299%

[0.5*(100+100)+5.25]/1.078827=97.5597

[0.5*(100+100)+5.25]/1.064791=98.8457

[0.5*(100+100)+5.3299]/1.053299=100

[0.5*(97.5597+98.8457)+5.25]/1.06=97.5969

[0.5*(98.8457+100)+4.9377]/1.049377=99.4500

PV0=[0.5*(97.5969+99.45)+4.4395]/1.044395=98.5862

计算结果与答案不同?

还有不shift的PV0如何计算?