NO.PZ2018091701000044

问题如下:

The benchmark portfolio is the Hang Sheng Index.

An analyst make conclusion:

Conclusion one: Portfolio C is closet index fund because its information ratio is very small.

Conclusion two: portfolio C is closet index fund because its Sharpe ratio is close to the benchmark.

Conclusion three: portfolio C is closet index fund because its active risk is the low

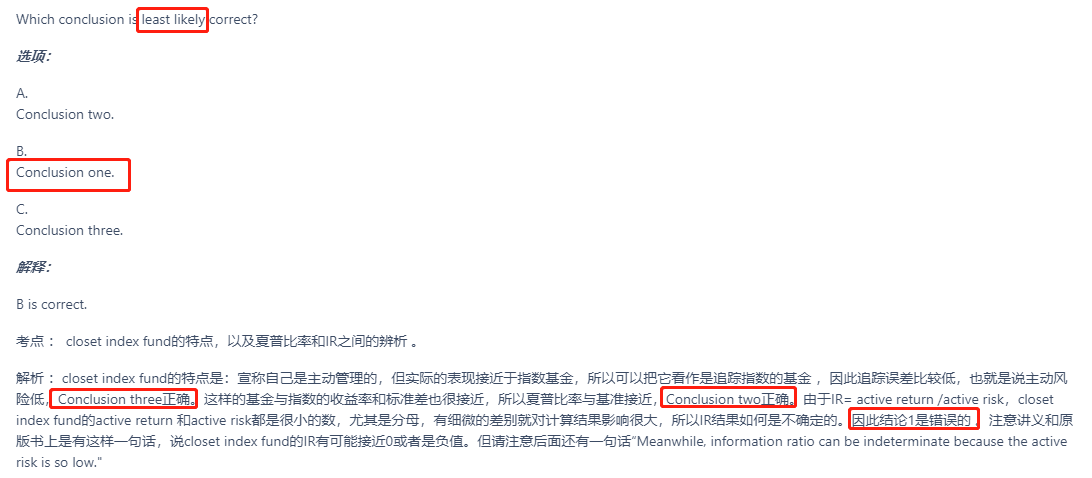

Which conclusion is least likely correct?

选项:

A.Conclusion two.

B.Conclusion one.

C.Conclusion three.

解释:

B is correct.

考点 : closet index fund的特点,以及夏普比率和IR之间的辨析 。

解析 :closet index fund的特点是:宣称自己是主动管理的,但实际的表现接近于指数基金,所以可以把它看作是追踪指数的基金 ,因此追踪误差比较低,也就是说主动风险低,Conclusion three正确。这样的基金与指数的收益率和标准差也很接近,所以夏普比率与基准接近,Conclusion two正确。由于IR= active return /active risk,closet index fund的active return 和active risk都是很小的数,尤其是分母,有细微的差别就对计算结果影响很大,所以IR结果如何是不确定的。因此结论1是错误的 。注意讲义和原版书上是有这样一句话,说closet index fund的IR有可能接近0或者是负值。但请注意后面还有一句话“Meanwhile, information ratio can be indeterminate because the active risk is so low."

解析说的是conclusion three是错的,答案却选了A,应该选C呀??