NO.PZ201712110100000202

问题如下:

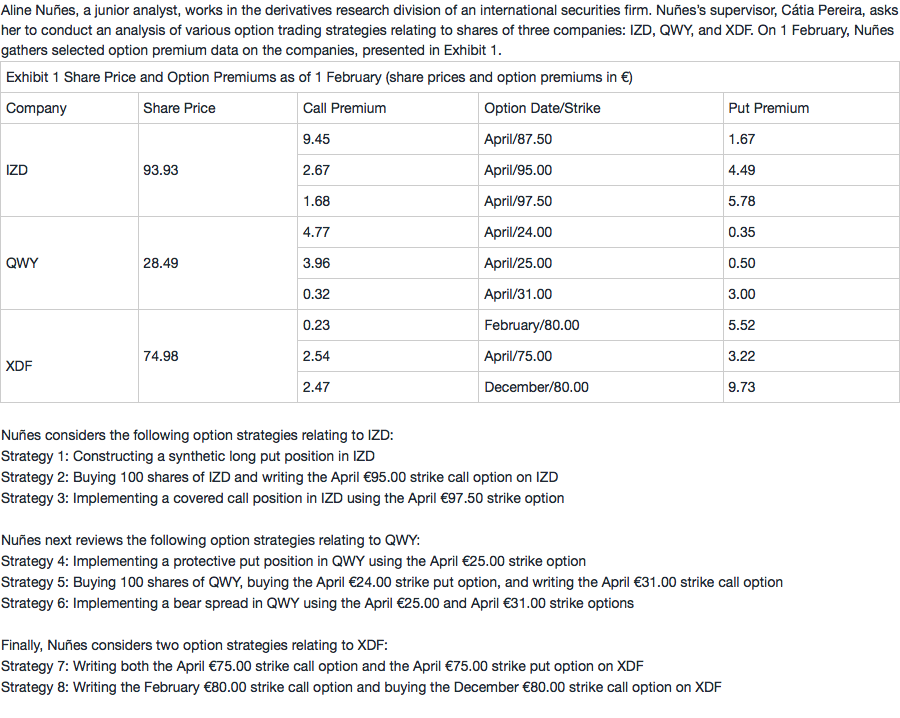

Based on Exhibit 1, Nuñes should expect Strategy 2 to be least profitable if the share price of IZD at option expiration is:

选项:

A.less than €91.26.

between €91.26 and €95.00.

more than €95.00.

解释:

A is correct.

Strategy 2 is a covered call, which is a combination of a long position in shares and a short call option. The breakeven point of Strategy 2 is €91.26, which represents the price per share of €93.93 minus the call premium received of €2.67 per share (S0 – C0). So, at any share price less than €91.26 at option expiration, Strategy 2 incurs a loss. If the share price of IZD at option expiration is greater than €91.26, Strategy 2 generates a gain.

中文解析:

策略2是covered call策略,它是由long stock + short call构成。该策略的盈亏平衡点是91.26欧元,即每股93.93欧元减去收到的每股2.67欧元的看涨期权期权费。

因此,在期权到期时,任何股价低于91.26欧元的情况下,该策略都会产生亏损。如果IZD在期权到期时的股价大于91.26欧元,该策略就会产生收益。

做到这题,看了下笔记,突然有点疑惑,covered call有最大loss吗?看图形不应该是unlimited吗?