NO.PZ201601050100000109

问题如下:

Recommend an alternative hedging strategy that will keep the hedge ratio close to the target hedge ratio. Identify the main disadvantage of implementing such a strategy.

选项:

解释:

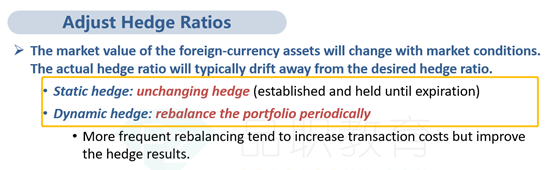

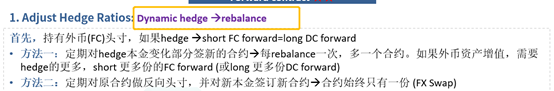

The fund manager should implement a dynamic hedging approach. Dynamic hedging requires rebalancing the portfolio periodically. The rebalancing would require adjusting some combination of the size, number, and maturities of the foreign-currency contracts.

Although rebalancing a dynamic hedge will keep the actual hedge ratio close to the target hedge ratio, it has the disadvantage of increased transaction costs compared to a static hedge.

中文解析:

基金经理应采用动态对冲方法。动态对冲需要周期性地重新平衡投资组合。再平衡需要调整外汇合约的规模、数量和期限。

虽然重新平衡动态套期保值会使实际套期保值比率接近目标套期保值比率,但与静态套期保值相比,它有增加交易成本的缺点。

Static Hedging vs Dynamic Hedging 框架图里好像没有?知识图谱里好像也没有这个考点