NO.PZ201601050100001606

问题如下:

Based on Exhibit 2, the NIFTY 50 Index implied volatility data most likely indicate a:

选项:

A.risk reversal.

volatility skew.

volatility smile.

解释:

B is correct.

When the implied volatility decreases for OTM (out-of-the-money)

calls relative to ATM (at-the-money) calls and increases for OTM puts relative

to ATM puts, a volatility skew exists. Put volatility is higher, rising from 16.44

ATM to 17.72 OTM, likely because of the higher demand for puts to hedge

positions in the index against downside risk. Call volatility decreases from 12.26

for ATM calls to 11.98 for OTM calls since calls do not offer this valuable portfolio insurance.

A is incorrect because a risk reversal is a delta-hedged trading strategy seeking

to profit from a change in the relative volatility of calls and puts.

C is incorrect because a volatility smile exists when both call and put volatilities, not just put volatilities, are higher OTM than ATM.

中文解析:

印度的NIFTY 50指数当前的交易水平为11610点,接近表格2中的11,600。因此可以认为执行价格为11,6000的期权是处在ATM状态的期权。

以看跌期权为例,执行价格高于11600的是ITM的期权;执行价格低于11600的是OTM的期权。

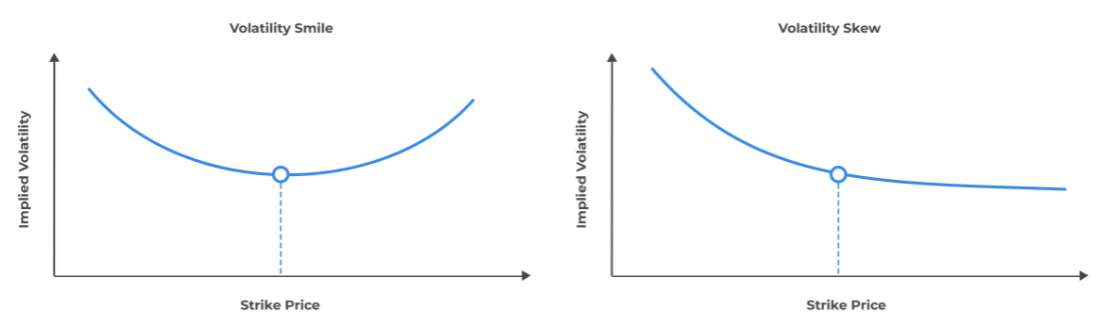

Volatility smile的图形显示的是不论是OTM 的put还是ITM的put,其隐含波动率都是高于ATM状态时的隐含波动率的。

Volatility skew的图形则显示的是OTM的put隐含波动率高于ATM状态的put;ITM的put其隐含波动率会略微低于ATM状态的put。

因此根据表格可知,这符合volatility skew的形态。

No.PZ201601050100001606