NO.PZ2020012201000007

问题如下:

Alena,CFA, was updating her firm’s projections for US equity returns.If she believed that in the long run that the US labor input would grow by 0.9% perannum and labor productivity by 1.5%, that inflation would be 2.1%, that the dividend yield would be 2.25%, and that there would be no further growth in P/E, what is likely to have been her baseline projection for continuously compounded long-term US equity returns?

选项:

A. 6.75%

5.5%

C.5.85%

解释:

A is correct

解释:

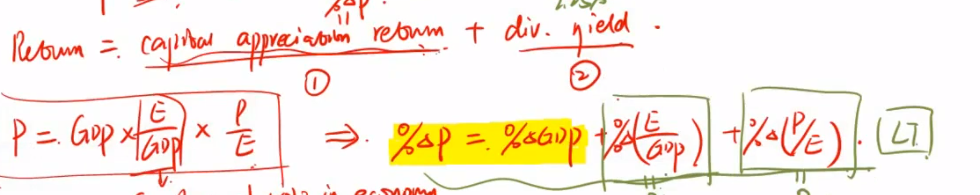

在长期,一国股票市场的增长率等于该国GDP的增长率(本题P/E增长率为0也证实了这一点)。那么本题就等于计算该国GDP的增长率。

Her baseline projection is likely to have been 6.75% = 0.9% + 1.5% + 2.1% + 2.25%

依照公式可得:. 6.75% = 0.9% + 1.5% + 2.1% + 2.25%

一直没有掌握好这个公式的fenj

这题这样理解吗

*D/P+增长率

增长率拆分

1 GDP增长+2 E/GDP增长+3 P/E增长

这题说第三项 p/e是0

第一项GDP是拆分为 labor input增长和 效率增长

那么第二项呢 这里是默认为0