NO.PZ2019012201000036

问题如下:

TMT has $250 million in assets under management. ABC.CO has a market capitalization of $3.0 billion, an index weight of 0.20%, and an average daily trading volume (ADV) of 1% of its market capitalization. TMT considers investing in ABC and has the following position size policy constraints:

Allocation: No investment in any security may represent more than 3% of total AUM.

Liquidity: No position size may represent more than 10% of the dollar value of the security’s ADV.

Index weight: The maximum position weight must be less than or equal to 10 times the security’s weight in the index.

Which of the following position size policy constraints is the most restrictive in setting TMT’s maximum position size in shares of ABC?

选项:

A.Liquidity

B.Allocation

C.Index weight

解释:

A is correct.

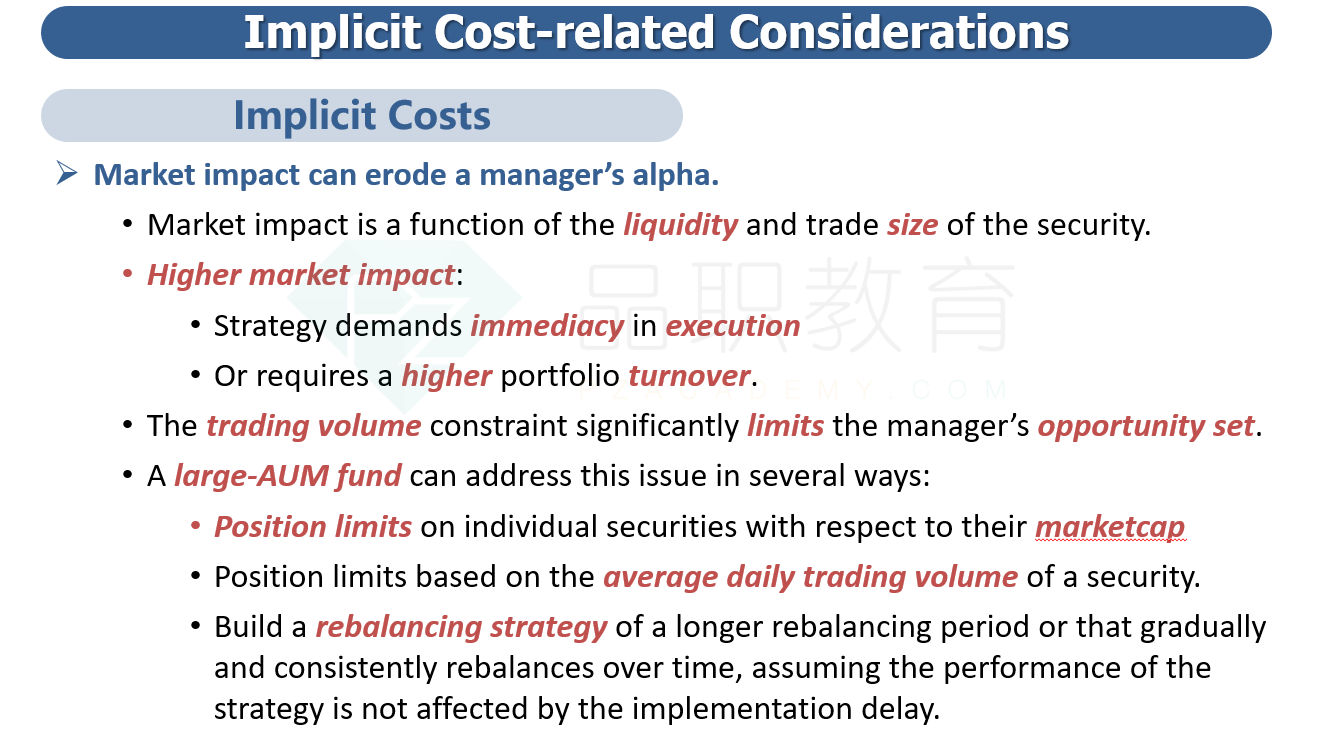

考点:Implicit Cost-related Considerations

解析: 根据三种限制要求,最大持仓规模分别计算如下:

ABC公司每日交易价值=ABC的市值×每日的交易量=$3 billion × 1.0% = $30 million

流动性限制= ABC公司每日交易价值×流动性限制=$30 million × 10% = $3 million

配置限制=管理的资产规模×最大头寸限制=$250 million × 3.0% = $7.5 million

指数权重限制=管理的资产规模×(指数权重×10)=$250 million × (0.20% × 10) = $5.0 million

由于流动性限制计算出来的最大持仓规模金额最小,因此它是最严格限制政策。

这是哪个知识点?看到这样的题目,感觉英语很难理解 费时,如果考试遇到 就想直接跳过

这个考点需要掌握吗?为什么感觉 看着这么难理解 各种限制条件