NO.PZ2020021205000045

问题如下:

A trader wants to create synthetically a nine-month European put futures option on 1 million times an index. The futures price is USD 2,500, the strike price is USD 2,400, the risk-free rate is 2%, and the volatility of the futures price is 20%. What position should the trader take in futures contracts initially? How does this differ from the position the trader would take if he or she were hedging the same nine-month European put futures option on 1 million times the index?

解释:

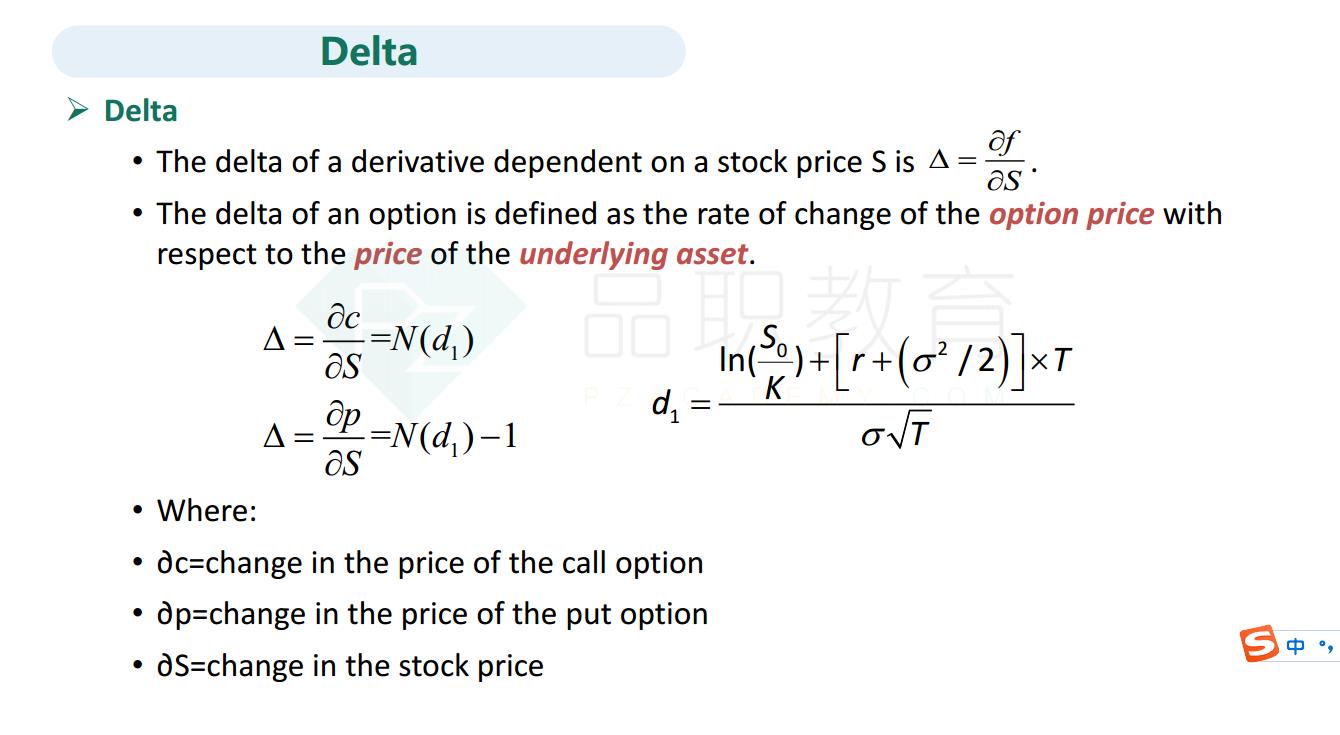

The delta of a long position in a put option on a futures price is e-rT[N(d1 ) - 1]. In this case:

d1== 0.3223

and delta is

[N(0.3223) - 1] = -0.368

The trader should short futures contracts on 368,000 times the index initially to match the delta of the position that is desired. If the trader were hedging 1 million put futures contracts he or she would take a long position in futures contracts on 368,000 times the index.

期货的delta啥的在哪里哦