做过的题你都能拿分吗?

临近考试,小编相信大家都开始启用“题海”战术,疯狂刷题,可是你现在做过的题,你考场碰到都能做对吗?

同为备考党的我,小编只想说,如果只做过一遍,那怕是有点难。

我相信大家都是从题海战术里走出来的朋友们,这其实就是一个熟能生巧的事情,即时可能你对某个知识点不理解,但是同一个题型你做完3次后,就有一种闭着眼睛我都能认出你的熟悉感,剥掉题干的外壳,其实都是同一个套路。

那么到底哪些题目是有典型考法的,哪些知识点是比较易错的点,这就是大家考前需要拿个小本本记下来的事情。

看到这里,是不是大家都有一种蠢蠢欲动,要赶紧去做笔记的想法?

知道目前大家都在争分多秒学习,贴心的品职教研组的小哥哥、小姐姐们也是熬夜赶工(心疼一下),帮大家整理了CFA三个级别学科的错题本,希望在最后的时候能给大家起到助力的作用。

在接下来的几周里,我们会陆续发放三个级别的高频问答,希望对大家的备考有所帮助。今天二级放上组合管理的错题本,大家一起来看看这些题都会做吗?

精选问答1

题干

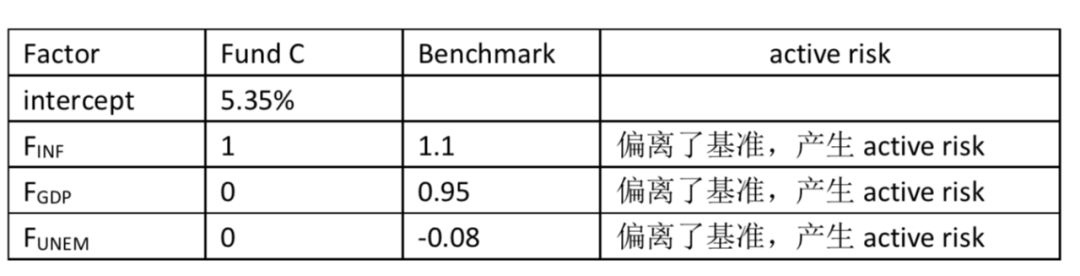

Based on the following table, macroeconomic two-factor model :

Which of the following statement is the active risk for Fund C?

A only inflation.

B expected return.

C all three model factors.

答案解析

C is correct.

解题思路

active risk,又叫trackingrisk或者tracking error,衡量的是跟踪基准的偏差。跟基准越同步,说明跟踪的越好,active risk才会越小,active risk接近0说明这个投资组合与基准的风险相似。所以这道题我们要比较Fund C 与Benchmark的factor sensitivity是否相同,由于三个factor sensitivity都不相等,所以这三个风险因子都让Fund C偏离了基准,产生active risk。

易错点分析

这道题有两个难点,一是很多同学没有真正理解active risk衡量的是跟踪基准的偏差,偏离基准就会产生active risk;二是Fund C只对一个风险因子敏感,Fund C其实就是我们学的Factor portfolio,这点给很多同学造成了很大的干扰,这也是这道题的高明之处;这道题提醒我们在学习的时候要真正理解每个概念的内涵,通过做题也可以不断帮助我们弄清楚一些易混淆的概念。

精选问答2

题干

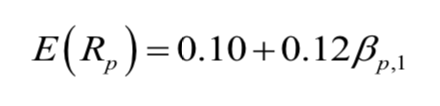

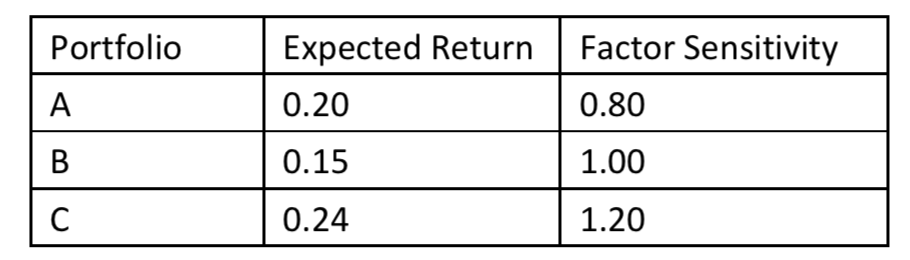

Assume that the following one-factor model describes the expected return for portfolios:

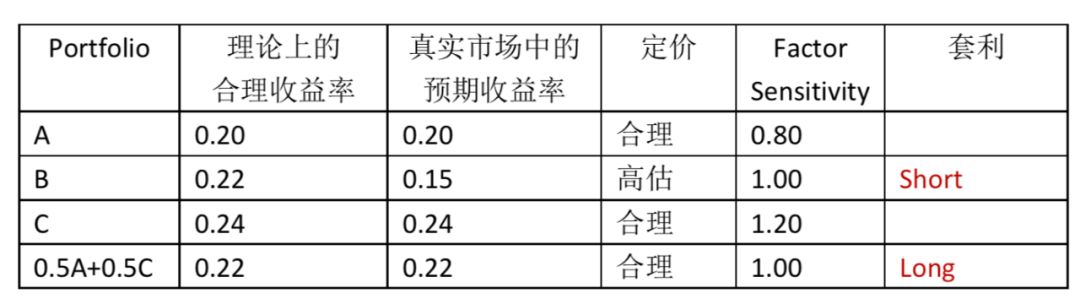

Also assume that all investors agree on the expected returns and factor sensitivity of the three highly diversifiedPortfolios A, B, and C given in the following table:

Assuming the one-factor model is correct and based on the data provided for Portfolios A, B,and C, determine if an arbitrage opportunity exists and explain how it might be exploited.

答案解析

According to the one-factor model for expected returns, the portfolio should have these expected returns if they are correctly priced in terms of their risk:

![]() Portfolio A: E(RA)= 0.10 + 0.12βA,1 = 0.10 + (0.12)(0.80) = 0.10 + 0.10 = 0.20

Portfolio A: E(RA)= 0.10 + 0.12βA,1 = 0.10 + (0.12)(0.80) = 0.10 + 0.10 = 0.20

![]() Portfolio B: E(RB) = 0.10+ 0.12βB,1 = 0.10 + (0.12)(1.00) = 0.10 + 0.12 = 0.22

Portfolio B: E(RB) = 0.10+ 0.12βB,1 = 0.10 + (0.12)(1.00) = 0.10 + 0.12 = 0.22

![]() Portfolio C: E(RC)= 0.10 + 0.12βC,1 = 0.10 + (0.12)(1.20) = 0.10 + 0.14 = 0.24

Portfolio C: E(RC)= 0.10 + 0.12βC,1 = 0.10 + (0.12)(1.20) = 0.10 + 0.14 = 0.24

In the table below, the column for expected return shows that Portfolios A and C are correctly priced but Portfolio B offers too little expected return for its risk, 0.15 or 15%.

By shorting Portfolio B (selling an overvalued portfolio)and using the proceeds to buy a portfolio 50% invested in A and 50% invested in C with a sensitivity of 1 that matches the sensitivity of B, for each monetary unit shorted (say each euro), an arbitrage profit of €0.22 -€0.15 = €0.07 is earned.

解题思路

第一步,我们要知道套利是什么,要想套利我们需要满足2个条件:一是不承担任何风险;二是不花一分钱,也就是空手套白狼。顺着这个思路,构建套利组合肯定是要short一个资产组合然后拿short的钱去long另一个资产组合,这样才是空手套白狼。那风险如何去除呢?就是让这两个组合之间的factor sensitivity大小相等,方向相反,可以互相抵消,这样就实现了零风险。

第二步,判断套利策略,即判断本题给出的三个资产是高估还是低估。

根据one-factor model,我们可以求出资产理论上的合理收益率,

Portfolio A: E(RA)= 0.10 + 0.12βA,1 = 0.10 + (0.12)(0.80) = 0.10 + 0.10 = 0.20

Portfolio B: E(RB) = 0.10+ 0.12βB,1 = 0.10 + (0.12)(1.00) = 0.10 + 0.12 = 0.22

Portfolio C: E(RC)= 0.10 + 0.12βC,1 = 0.10 + (0.12)(1.20) = 0.10 + 0.14 = 0.24

然后对比资产理论上的合理收益率与真实市场中的预期收益率。

注意,Portfolio B理论上的合理收益率>真实市场中的预期收益率→由于收益率与价格是反向的关系,说明Portfolio B理论上的合理价格<真实市场中的预期收益率→Portfolio B被高估→在套利策略中应该short Portfolio B,同时 PortfolioA和C的市场定价是合理的,为了对冲风险,要同时long Portfolio (A,C)。

通过直观的看三个组合的Factor Sensitivity,可以看出0.8和1.2平均可以得到1。

即套利组合=short Portfolio B+ long Portfolio (0.5A+0.5C)

三是,计算套利利润。

套利组合=short Portfolio B+ long Portfolio (0.5A+0.5C)

套利利润= -0.15+0.22 =0.07

易错点分析

这道题主要有两个难点,一是部分同学没有分清资产理论上的合理收益率(公式计算出来的)与真实市场中的预期收益率(市场观察得来的);二是收益率与价格是反向的关系,构建套利组合 “低买高卖”指的是价格的高低(不是收益率),有些同学在这里容易混淆。希望这道题能帮助大家真正理解如何构建套利组合。

精选问答3

题干

One interpretation of an upward sloping yield curveis that the returns to short-dated bonds are:

A uncorrelated with bad times.

B more positively correlated with bad times than are returns to long-dated bonds.

C more negatively correlated with bad times than are returns to long-dated bonds.

答案解析

C is correct.

One interpretation of an upward sloping yield curve is that returns to short-dated bonds are more negatively correlated with bad times than are returns to long-dated bonds.

This interpretation is based on the notion that investors are willing to pay a premium and accept a lower return for short-dated bonds if they believe that long-dated bonds are not a good hedge against economic "bad times".

解题思路

这道题很多同学没看懂题目考点是什么,我们可以从两个方向入手:

首先,直接观察答案,negatively correlated with bad times的意思就是在经济变差的时候该资产可以作为避险工具,由于经济差的时候,短期债比长期债更加稳健,所以短期债是比长期债更好的避险工具,所以只有选项C这句话是正确的。

其次,从题干出发,这里的upward sloping yield curve可以从两个角度理解:

一是yieldcurve反映的是投资者要求回报率(也就是债券的折现率)。由于经济差的时候,短期债比长期债稳健,大家都更愿意去投资短期债,所以对短期债的要求回报率是比较低的,对长期债的要求回报率高,所以yield curve呈现向上倾斜的趋势。

二是经济差的时候,央行会降息,降息对短期利率影响更大,所以yield curve也是向上倾斜的。

易错点分析

这道题有三个难点:

![]() 一是很多同学没有读懂题干,类似的题目可以像这道题的解体思路一样,可以从答案入手来理解;

一是很多同学没有读懂题干,类似的题目可以像这道题的解体思路一样,可以从答案入手来理解;

![]() 二是很多同学没有想到考点是什么,我们要多熟悉和记忆Economicsand Investment Markets这个reading的定性的结论。

二是很多同学没有想到考点是什么,我们要多熟悉和记忆Economicsand Investment Markets这个reading的定性的结论。

![]() 三是部分同学对“returnto short-dated bonds与bad time是负相关的”这个结论有点迷惑,这里是针对现在手中已经持有短期债的投资者来说的,这里的return并不是折现率的意思,而是指的是持有期收益率,在经济变差的时候短期债需求变大,价格上涨,因此短期债的持有期收益率高。所以经济越差,return to short-dated bonds越高,两者是负相关的。

三是部分同学对“returnto short-dated bonds与bad time是负相关的”这个结论有点迷惑,这里是针对现在手中已经持有短期债的投资者来说的,这里的return并不是折现率的意思,而是指的是持有期收益率,在经济变差的时候短期债需求变大,价格上涨,因此短期债的持有期收益率高。所以经济越差,return to short-dated bonds越高,两者是负相关的。

精选问答4

题干

An analyst, who measures yield as a combination of interest rates and premiums, observes an upward-sloping, default-free government bond nominal yield curve. Which of the following statements is correct?

A Interest rates must be expected to rise in the future.

B Bond risk premiums must be expected to rise in the future.

C Expectations relating to the future direction of interest rates are indeterminate.

答案解析

C is correct.

An upward sloping yield curvemay be caused by a combination of expected rate increases and positive bond risk premiums.

It may also be a combination of expectations that interest rates will be unchanged in the future coupled with positive bond risk premiums.

Lastly, an upward sloping yield curve may actually be a reflection of expected rate cuts that are more than offset by the existence of positive bond risk premiums.

So, expectations relating to the future direction of interest rates are indeterminate.

解题思路

债券市场的收益率可以简单地划分为两部分,一是risk-free interest rate,二是risk premium。如果收益率曲线表现为上升,那么有三种可能:

![]() risk-free interest rate和risk premium同时上升;

risk-free interest rate和risk premium同时上升;

![]() risk-free interest rate上升,risk premium下降,但是前者上升的幅度超过后者下降的幅度;

risk-free interest rate上升,risk premium下降,但是前者上升的幅度超过后者下降的幅度;

![]() risk-free interest rate下降,risk premium上升,但是前者下降的幅度小于后者上升的幅度。

risk-free interest rate下降,risk premium上升,但是前者下降的幅度小于后者上升的幅度。

因此仅观察债券市场的收益率曲线不能判断未来预测利率变化的方向。

易错点分析

这道题有两个难点,一是有些同学没有读懂题目的意思,不知道题目在说什么,日常练习的时候遇到定性的题目,可以多读几遍题目,要熟悉协会的定性表述。二是没有想到考点是什么,我们要多熟悉和记忆Economics and InvestmentMarkets这个reading的定性的结论。

精选问答5

题干

You are analyzing three investment managers for a new mandate. The table below provides the managers’ ex-ante active return expectations and portfolio weights. The last two columns include the risk and the ex-post, realized active returns for the four stocks. Use the following data for the following two questions:

Suppose all three managers claim to be good at forecasting returns. According to the full fundamental law of active management, which manager is the best at efficiently building portfolios by anticipating future returns?

A Manager 1

B Manager 2

C Manager 3

答案解析

C is correct.

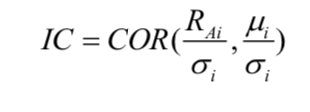

The properstatistic to calculate is the information coefficient, and it is defined as follows:

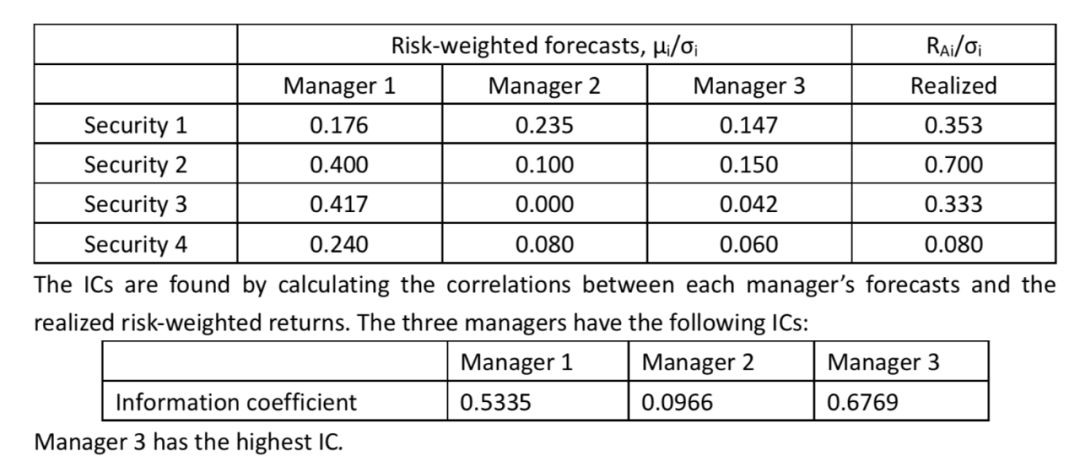

A manager is a good forecaster if his or her ex-ante active return expectations (forecasts) are highly correlated with the realized active returns. The information coefficient requires that these forecasts and realized returns be risk-weighted. When this is done for the three managers, the risk weighted forecasts and realized returns are:

解题思路

三个基金经理都声称自己擅于预测收益率,而题目问whichmanager is the best at efficiently building portfolios by anticipating futurereturns? 这句话的重点其实是by anticipating future returns,基金经理预测未来收益率能力,衡量指标是IC,IC越大,预测能力越强。

计算公式为

也就是求风险调整后的forecasted active returns与realized active returns之间的相关性。

如英文答案中的表格所示,首先计算Risk-weighted forecasts return和Risk-weighted realized return,然后使用计算器求correlation。

以Manager 1为例:

【2nd】【7】进入data模式,首先清除历史记录【2nd】【CLR WORK】

依次输入两组数据:X01=0.176【↓】Y01=0.353【↓】X02=0.400【↓】Y02=0.700【↓】X03=0.417【↓】Y03=0.333【↓】X04=0.240【↓】Y04=0.080

然后[2nd][8]进入STAT模式,一直按向下的箭头,直到出现r,r=0.5317。(与英文答案略有差异,是保留小数点的误差。)

易错点分析

这道题有三个难点,一是有些同学没有读懂题目的意思,不知道题目在问什么,本题问which manager is the best at efficiently buildingportfolios by anticipating future returns? 这句话的重点其实是by anticipating future returns,基金经理预测未来收益率能力,衡量指标是IC;

还有另一道题问which manager is the best at building to make fulluse of their ability to correctly anticipate returns? 这道题问哪个基金经理能够最有效实现构建组合的想法,也就是基金经理的执行能力,衡量指标是TC;日常练习的时候遇到定性的题目,可以多读几遍题目,要熟悉协会的定性表述。二是不记得IC的计算公式。三是不知道如何用计算器计算correlation。