做过的题你都能拿分吗?

临近考试,小编相信大家都开始启用“题海”战术,疯狂刷题,可是你现在做过的题,你考场碰到都能做对吗?

同为备考党的我,小编只想说,如果只做过一遍,那怕是有点难。

我相信大家都是从题海战术里走出来的朋友们,其实刷题就是一个熟能生巧的事情,即使可能你对某个知识点不理解,但是同一个题型你做完3次后,就有一种闭着眼睛我都能认出你的熟悉感,剥掉题干的外壳,其实都是同一个套路。

那么到底哪些题目是有典型考法,哪些知识点是易错的点,哪些是协会的惯用套路,这就是大家考前需要拿个小本本记下来的事情。

看到这里,是不是大家都有一种蠢蠢欲动,要赶紧去做笔记的想法?

知道目前大家都在争分多秒学习,贴心的品职教研组的小哥哥、小姐姐们也是熬夜赶工(心疼一下),帮大家整理了CFA三个级别学科的错题本,希望在最后的时候能给大家起到助力的作用。

在接下来的几周里,我们会陆续发放三个级别的高频问答,希望对大家的备考有所帮助。今天三级放上行为金融学的错题本,大家一起来看看这些题都会做吗?

精选问答1

题干

The final topic of the day was the impact of behavioral finance on capital markets. After a rigorous debate for and against the Efficient Market Hypothesis, Green and Weaver reached the following conclusions:

Conclusion 1 Support exists for both efficient markets and anomalous markets.

Conclusion 2 By understanding investor behavior, the investment solutions that are constructed will be closer to the rational solution provided by traditional finance.

Conclusion 3 If a market is strong form efficient,sophisticated investors may be better positioned to outperform less savvyparticipants.

Which of Green and Weaver’s conclusions regarding market behavior is least likely correct?

Conclusion 1

Conclusion 3

Conclusion 2

答案解析

B选项正确。

Conclusion 3 is least likely correct. Green and Weaver’s conclusion regarding sophisticated investors being better positionedto outperform less savvy participants in efficient markets is incorrect.

Only in inefficient markets may sophisticated investors have an advantage. In theory if markets are strong form efficient neither investor would have an advantage.Both Conclusion 1 regarding support for both efficient markets and anomalousmarkets and Conclusion 2 regarding the construction of investment are both correct.

解题思路

Conclusion1说的是有效市场和有异常的市场都有支持,正确。Efficient market有效市场假说,分为三大类:weak form, semi-strong, strong form。Anomalousmarket也有支持,比如说calendar anomalies, fundamentalanomalies (size, value) 。

Conclusion2说的是通过理解投资者的行为,投资决策可以更接近于传统金融学的理性决策,正确。了解了投资者的行为,如果是认知偏差,就纠正;如果是情感偏差,可以提建议。最终是为了让投资决策更优更理性。

Conclusion3说的是市场如果强有效,专业的投资者业绩会超过不专业的人,错误。如果市场强有效,所有人都可以获得历史信息、公开信息、非公开信息,也就是每个人都掌握了市场上所有的信息,那也就没有人能战胜市场,专业和非专业的业绩相同。

易错点分析

这道题是提问比较多的一道题。很多同学不理解conclusion 2,看到“investorbehavior”就觉得肯定不是traditional finance, 就选了C。但是我们学习行为金融,了解行为偏差,并不是为了更好地放飞自我,而是为了尽量克服这些偏差,从而做出最接近传统金融中rational solution的决定。所以conclusion2 是正确的。

精选问答2

问题

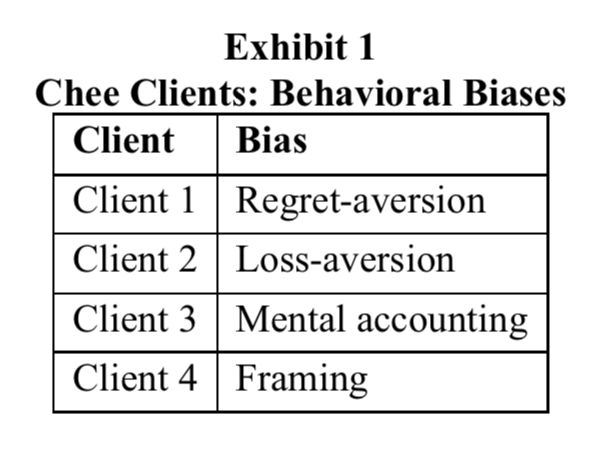

Over the years, Chee regularly surveyed her clients to detect any behavioral biases in their investment decision-making processes.

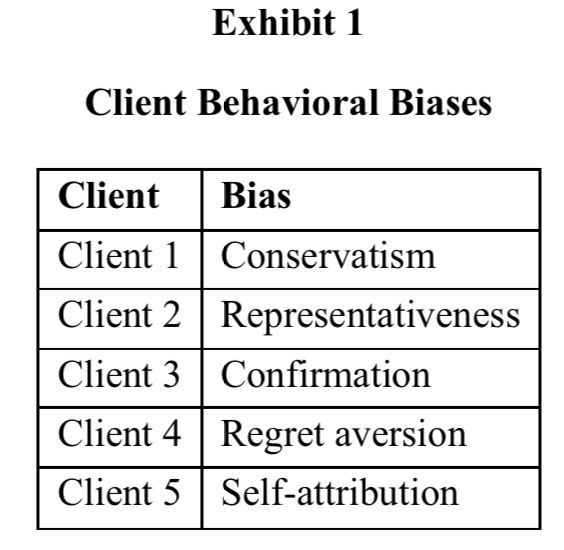

She determined that her clients routinely exhibited the biases summarized in Exhibit 1.

Client 1

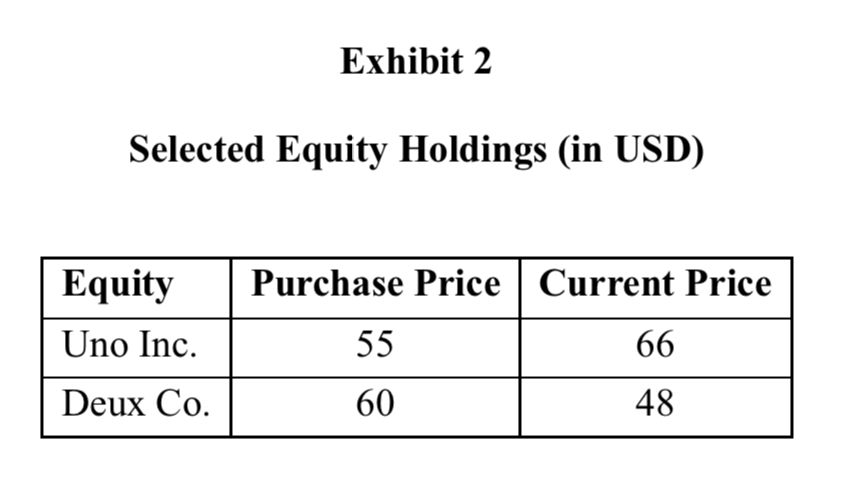

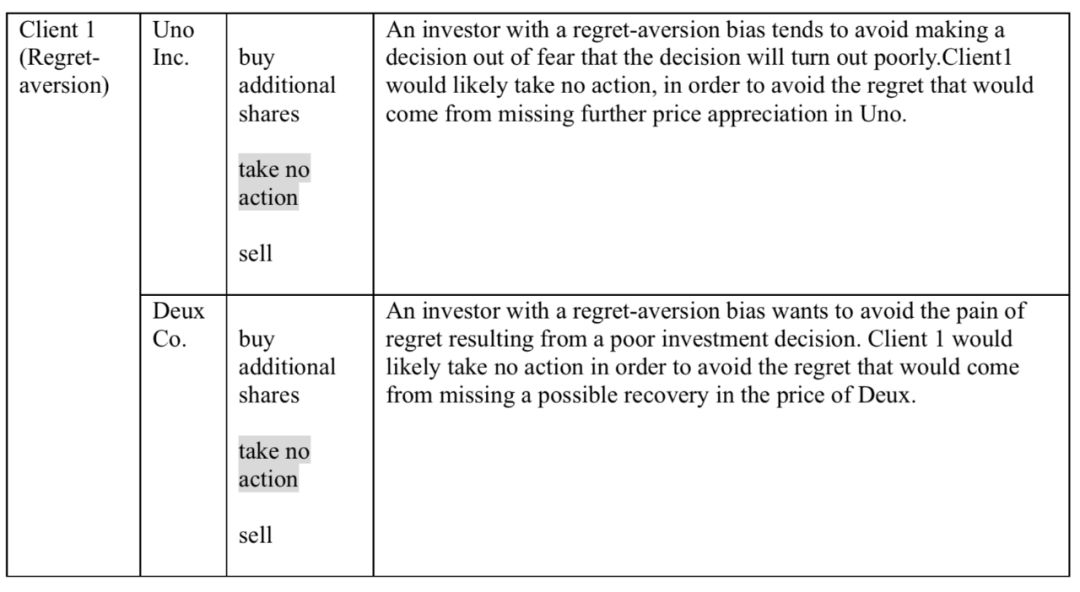

Rodriquez asks Client 1 to consider two equities, UnoInc. and Deux Co., which each had purchased for their respective portfolios.The purchase price and current price are shown in Exhibit 2. Neither equitypays dividends.

Determine, assuming Chee’s bias assessments arecorrect, which action (buy additional shares, take no action, sell) client 1 will most likely choose for each of the following equities:

i. Uno Inc.

ii. Deux Co.

Justify each response.

答案解析

解题思路

Regret aversion指的是因为害怕后悔而避免做决定。已经持有股票,client 1既担心股票跌遭受损失,又怕股票涨自己抛的早,所以保持现状不动。因此,当没有其他人影响时,无论股价涨跌,client 1 都不会买卖。

易错点分析

Regret aversion 并不代表一定不会有行动。Regret aversion的一个后果就是herding behavior 羊群效应。客户容易受到其他人的影响。具体请看下一道题的对比。

精选问答3

问题

Laura Stone is a financial advisor at an investment firm with clients who are active traders. She determines that several of her clients routinely exhibit the behavioral biases shown in Exhibit 1.

Stone believes that these clients act primarily on the basis of their biases. She schedules meetings with these clients to evaluate their investment portfolios and make recommendations.

Client 4

One year later, the equity market is up 30% and both trading volume and market volatility have increased. All client accounts have benefited and Client 4 has been actively buying equities as the market rises. Stone believes the market is overvalued and that the collective behavior of investors is contributing to the formation of a market bubble.

Explain how Client 4’s trading behavior is consistent with his observed bias.

答案解析

The regret aversion bias can initiate herding behaviorin individuals. Regret aversion causes financial market participants to avoid the pain of regret resulting from a poor investment decision, whether the loss comes from an investment that goes down or a perceived loss resulting from astock that went up that they did not own.

Client 4’s trading behavior of actively buying equities as the market rises is consistent with their regret aversion bias.Regret aversion can also encourage investors to participate in a bubble,believing they are potentially missing out on profit opportunities as stocks continue to appreciate.

解题思路

Regret aversion会导致羊群效应,也就是跟风,看到大家都在买或者都在抛,就跟着一起买卖。题干中说“股票市场涨了30%,所有人都受益了",大家都买了,所以regret-aversion的人也跟风一起买了。

易错点分析

Regret aversion 的本质是不想犯错,害怕后悔。因此它并不代表一定不动,如果是有别人的影响,regret aversion的人会想要和别人一样。如果没有别人影响,regret aversion的人就不动。这道题与上题考核知识点类似,因此放在一起对比。

精选问答4

问题

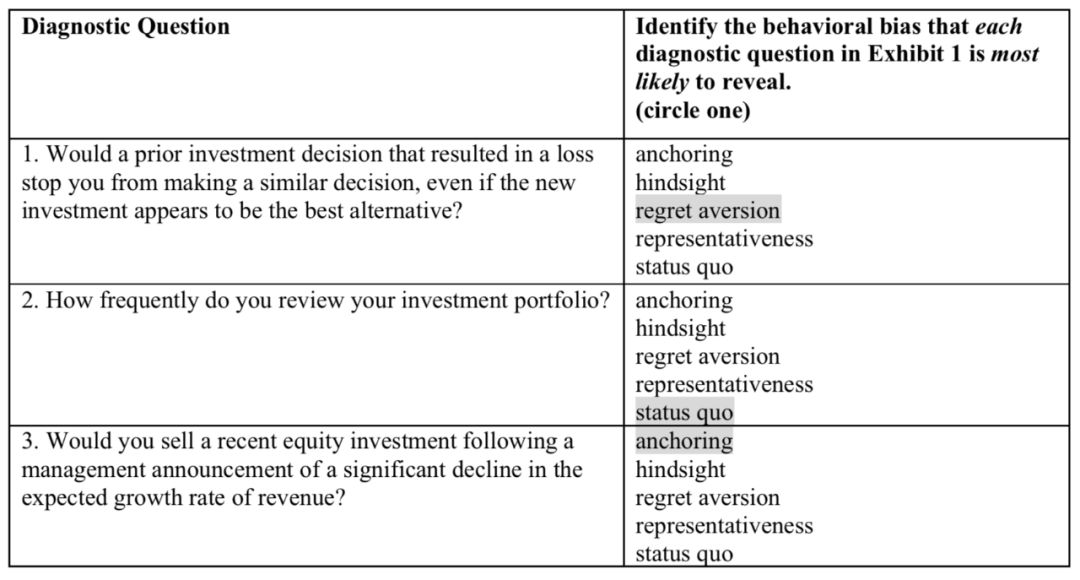

An advisor for Alesi Capital Management is workingwith a new client, Melanie Stoffer. Prior to meeting with her, the advisor asksStoffer a series of diagnostic questions to determine whether she may have anyof the following investment behavioral biases:

• anchoring

• hindsight

• regret aversion

• representativeness

• status quo

Sample diagnostic questions are shown in Exhibit 1.

Identify the behavioral bias thateach diagnostic question in Exhibit 1 is most likely to reveal.

答案解析

Regret aversion refers to the influence of pastdecisions (associated with poor investment performance) on similar choices inthe present. Often, rational actions are not taken in order to avoid arecurrence of the regret experienced after the past decision(s).

Status quo bias is an emotional bias in which peopledo nothing (i.e., maintain the “status quo”) instead of making a change. Peopleare generally more comfortable keeping things the same. This bias might preventan investor from looking for opportunities where change may be beneficial.

Anchoring is the tendency to continue usinginformation that had been used in past decisions despite the availability andrelevance of new information. As a result, investment decisions becomedifficult to reverse when the new information indicates that a change isadvisable.

解题思路

Regret aversion指的是因为害怕后悔而避免做决定。第一个问题的regret aversion主要体现在后半句,“even if thenew investment appears to be the best alternative”,即使新投资看起来是最好的选择也不选,因为以前类似的投资亏损过,害怕投资再亏损,是一种担心自己后悔的心理的表现。

Status quo指的是因为懒得动而不做决定。

Anchoring是锚定的意思,指的是做决定会受到一开始的数字的影响。anchoring通常会给一个初始值,看出现新信息后有没有在初始值的基础上调整预期价值。这道题比较难的地方是它没有给出这个数字,但是锚定在买入股票时的价格上(隐含的锚定数字)忽略了新的信息,所以没有卖出股票,所以选anchoring.

易错点分析

这道题是提问次数很高的一题。第一个问题很多同学选了representativeness. Representativeness指的是因为投资人见识少,根据自身有限的经历总结了错误的规律/模版,把新信息往模版上套,是处理新信息的方式不对。而regretaversion主要体现在后半句,即使新投资看起来是最好的选择也不选,因为害怕会后悔。要注意区分。

精选问答5

题干

Emerald believes there are significant benefits to incorporating behavioral finance as part of their client assessment process andhas recently made changes to this effect.

Benefits of the recent changes to Emerald's clientassessment process least likely include:

closer adherence to client expectations.

reducing portfolio risk.

improving Emerald's client retention metrics.

答案解析

选B.

Incorporating behavioral finance does not have adirect impact on portfolio risk. In some cases, this approach will help encouragea reduction in portfolio risk, but it may also help other clients to take onmore risk as appropriate.

Investing as the client expects and improvements to client retention metrics are both benefits of incorporating behavioral finance.

解题思路

这道题问考虑客户的行为变差的好处最不可能包含哪项。

A说的是更接近客户预期,正确。

B说的是降低投资风险,错误。了解客户的行为偏差和降低投资风险没有直接关系。增加风险还是降低风险取决于客户的风险偏好。

C说的是增强留住客户的手段,正确。

易错点分析

B选项是迷惑项。行为偏差属于行为金融,与账户风险没有直接关系。

精选问答6

题干

Philly’s investment committee also met with the irresearch analyst that covers the computer hardware industry to discuss thepotential purchase of LTop Computers, a leading manufacturer of personal computer and tablets.

Philly’s research analyst presented his investment recommendation and upgraded his rating on the stock to buy from hold given LTop’s new product introductions and an improved earnings outlook.

During the discussion, committee chair Jackson Burke commented that he had suffered amajor loss in LTop stock in the past so he would not be able to support buying the stock regardless of the improved outlook. There was little furtherdiscussion and the remaining committee members supported Burke’s view.

What behavioral bias most likely influenced the investment committee members to decide against the purchase of LTop stock?

Loss Aversion.

Overconfidence.

Social Proof.

答案解析

选C。

Burke’scomment that he had suffered a major loss in LTop stock in the past and becauseof that experience he would not be able to support buying the stock regardless of the improved outlook and analyst upgrade unduly influenced the othercommittee members.

The committee member’s actions demonstrated Social Proof,they wrongly endorsed the Investment Committee Chair’s judgement and they maynot have been fully aware they were doing so.

解题思路

Loss aversion是损失厌恶。题干中亏损这件事情发生在过去,现在已经结束了。

Overconfidence指的是过度自信,俗称专家病。

Social proof 指的是社会认同,是一种从众心理。个人会做出和他人一样的行为,来获得群体的认同。题干中说“There was little further discussion and the remaining committee members supported Burke’s view”.Committee members 为了得到他人的认同,没怎么讨论就支持了Burke的观点。

易错点分析

这道题的关键点在最后一句话。Social proof 强调的是在集体环境中做决定,而且通常这个决定的结果比较差。

精选问答7

题干

Over the next week, Owen and Yang are scheduled to meet with Fillman Associates, Philly’s largest institutional client. Owen mentions that Fillman is more sophisticated than Philly’s typical client. To prepare for the meeting Yang reviews several of Fillman’s annual due diligence forms completed by Owen.

One question in particular catches her attention: it asked how the firm’s equity portfolios performed during the 2005–2007residential property boom and how the equity turnover rates varied fromprevious years when the markets were more efficient. In part, the response read, “During the residential property boom of 2005–2007 equity trading activity was significantly higher than previous years when the markets were moreefficient. Our trading expertise allowed us to consistently harvest profits.”

What behavioral bias is most likely indicated by Philly’s equity turnover rates during the 2005–2007 residential boom?

Herding.

Overconfidence.

Recency effect.

答案解析

选B

Philly’s increased trading activity is indicative of overconfidence. In bubbles investors often exhibit symptoms of overconfidence;overtrading, under-estimation of risks, failure to diversify, and rejection of contradictory information.

With overconfidence, investors are more active andtrading volume increases, thus lowering their expected profits. Overconfidence and excessive trading are linked to confirmation bias and self-attribution biasas well as hindsight bias and the illusion of knowledge.

解题思路

Herding羊群效应,别人买我也买,别人抛我也抛,题干中没有体现。

Overconfidence过度自信。题干中的最后一句话“Our trading expertise allowed usto consistently harvest profits”是关键。Consistently harvestprofits说明是持续性的收益,明显的过度自信。

Recency effect,就是availability bias, 题干中也没有表现。

易错点分析

有的同学觉得herding 会导致bubble,就选了A.追涨杀跌确实是bubble形成的一个可能的因素,但是题目中并没有提到。做选择时还是要仔细看题目中的说法。