NO.PZ2020033003000097

问题如下:

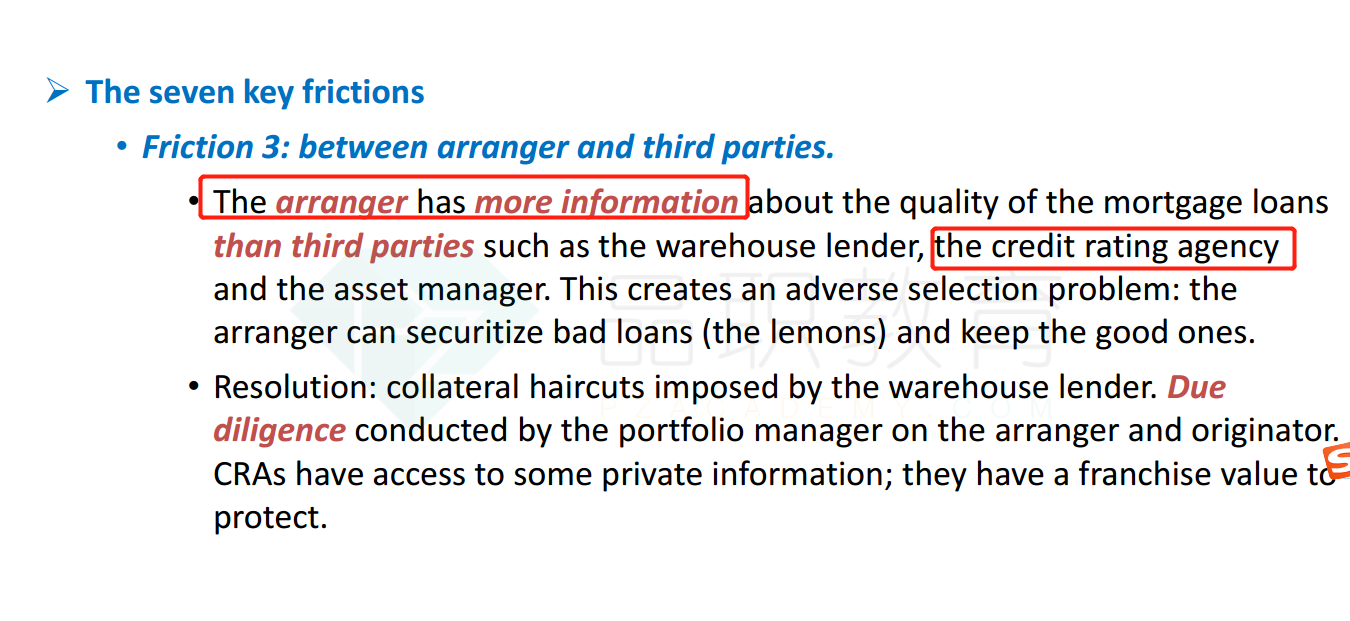

There is an important information asymmetry between the arranger and third parties concerning the quality of mortgage loans. In particular, the fact that the arranger has more information about the quality of the mortgage loans creates an adverse selection problem. Which of the following frictions do NOT represent an adverse selection problem?

选项:

A.Arranger and servicer.

B.Arranger and asset managers.

C.Arranger and warehouse lender.

D.Arranger and rating agencies.

解释:

A is correct.

考点:Adverse selection problem

解析:

The arranger can securitize bad loans (the lemons) and keep the good ones (or securitize them elsewhere). The third friction in the securitization of subprime loans affects the relationship that the arranger has with the warehouse lender, the credit rating agency (CRA), and the asset manager.

请解释一下D选项