NO.PZ2016082404000018

问题如下:

A firm is going to buy 10,000 barrels of West Texas Intermediate Crude Oil. It plans to hedge the purchase using the Brent Crude Oil futures contract. The correlation between the spot and futures prices is 0.72. The volatility of the spot price is 0.35 per year. The volatility of the Brent Crude Oil futures price is 0.27 per year. What is the hedge ratio for the firm?

选项:

A. 0.9333

B. 0.5554

C. 0.8198

D. 1.2099

解释:

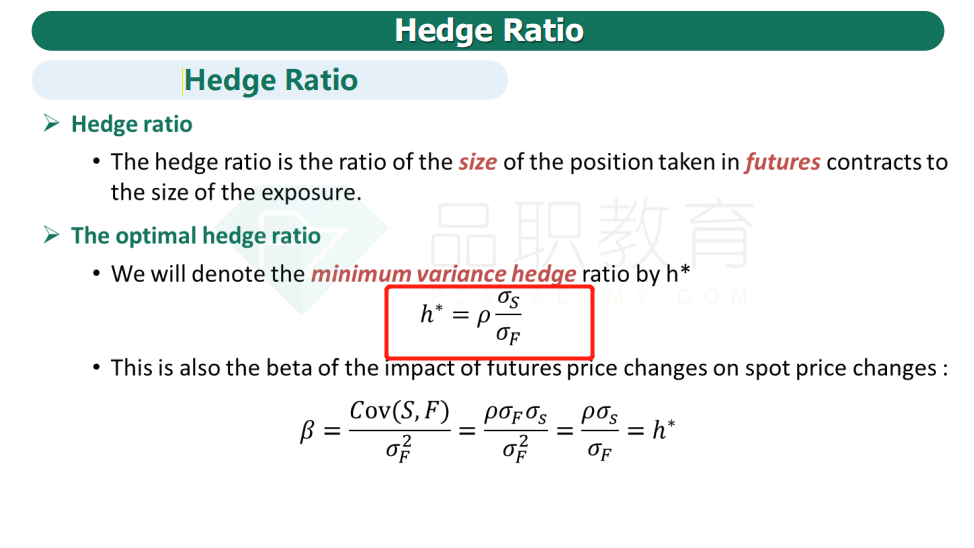

ANSWER: A

The optimal hedge ratio is .

不是应该用standard deviation吗 volatility开根号