NO.PZ2016021706000003

问题如下:

Megan, a student learning corporate finance this year, wrote down something about NPV and IRR on her notebook.

Statement 1: The IRR is the discount rate that makes the project's present value of cash inflows equal to the present value of cash outflows.

Statement 2: Analyst should use the IRRs to select the project, if the IRR method gives a different ranking result from the NPV method.

Statement 3: The NPV is the present value of the future after-tax cash flows minus the investment outlay.

Statement 4: If IRR> the required rate of return, accept the project.

Which of Megan's statements are correct?

选项:

A.Statement 1, 3

B.Statement 1, 3, 4

C.Statement 2, 4

解释:

B is correct.

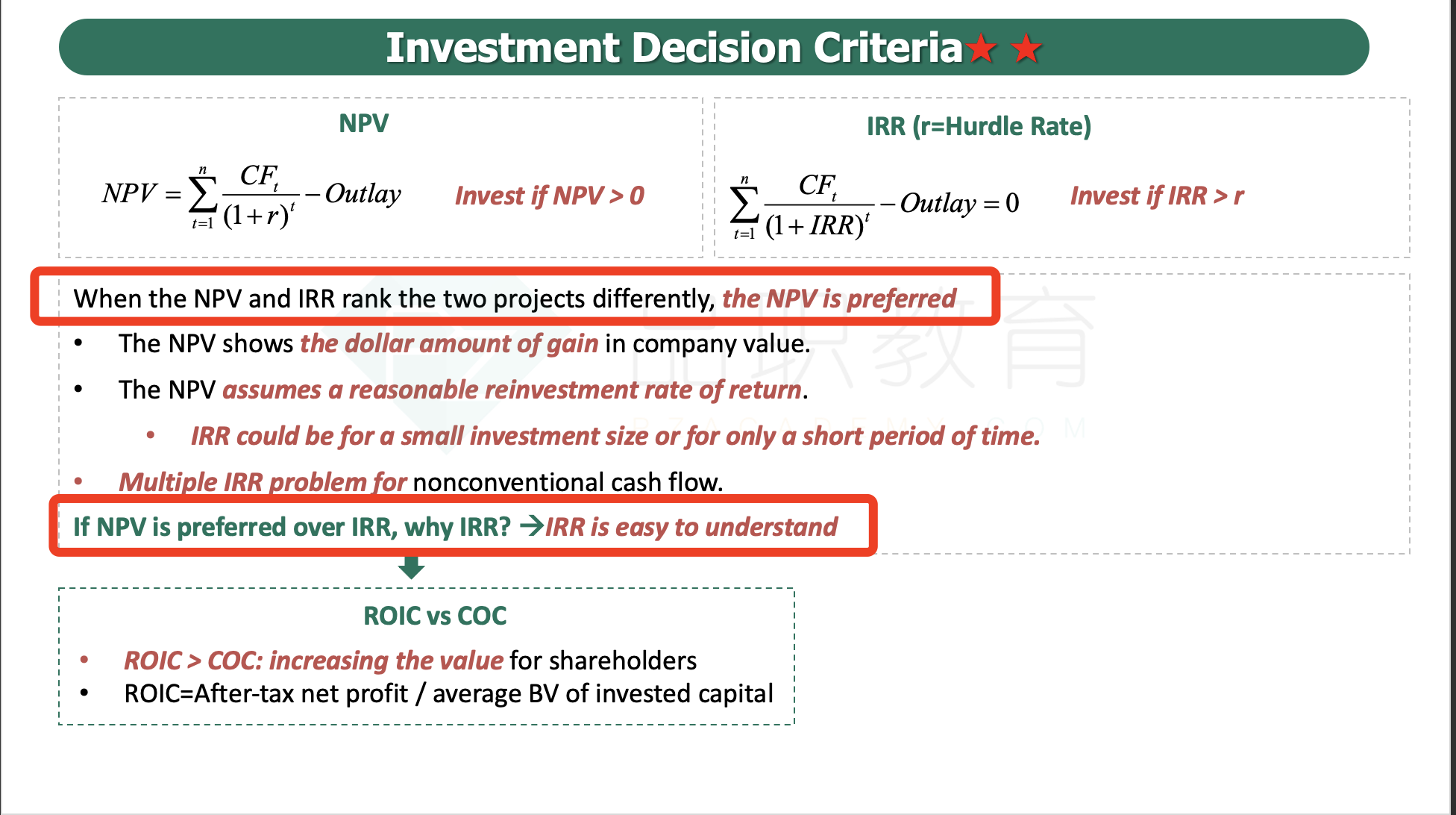

Statement 2 is incorrect, because the NPV method should be selected if NPV and IRR give conflicting decisions. Statement 1,3,4 are all correct.

我记得在这套题对应的讲义里说过书上觉得irr更好,因为irr更好理解。所以在考试的时候我们应该用书上这个结论吗?还是说就是npv更好呢