问题如下:

T-vision Inc, complies with US GAAP, the company has been expanding by acquiring other internet company, its largest acquisition, that of Heat internet company. T-vision Inc is currently forming a 50/50 joint venture with Alfa company under which the companies will share control of Heat internet company. T-vision plans to use the equity method to account for the joint venture. Alfa company complies with IFRS and will use the proportionate consolidation method to account for the joint venture.

Fabian, CFA, work on the Equity investment company, he has estimated the joint venture’s financial information for 2012. Fabian is preparing his estimates of each company’s earnings and financial performance. This information is presented in following table:

Alfa company recently announced it had formed a special entity through which it plans to sell up to ¥50 million of its accounts receivable. Alfa has no voting interest in the SPE, but it is expected to absorb any losses that it may incur. Fabian wants to estimate the impact this will have on Alfa’s consolidated financial statement.

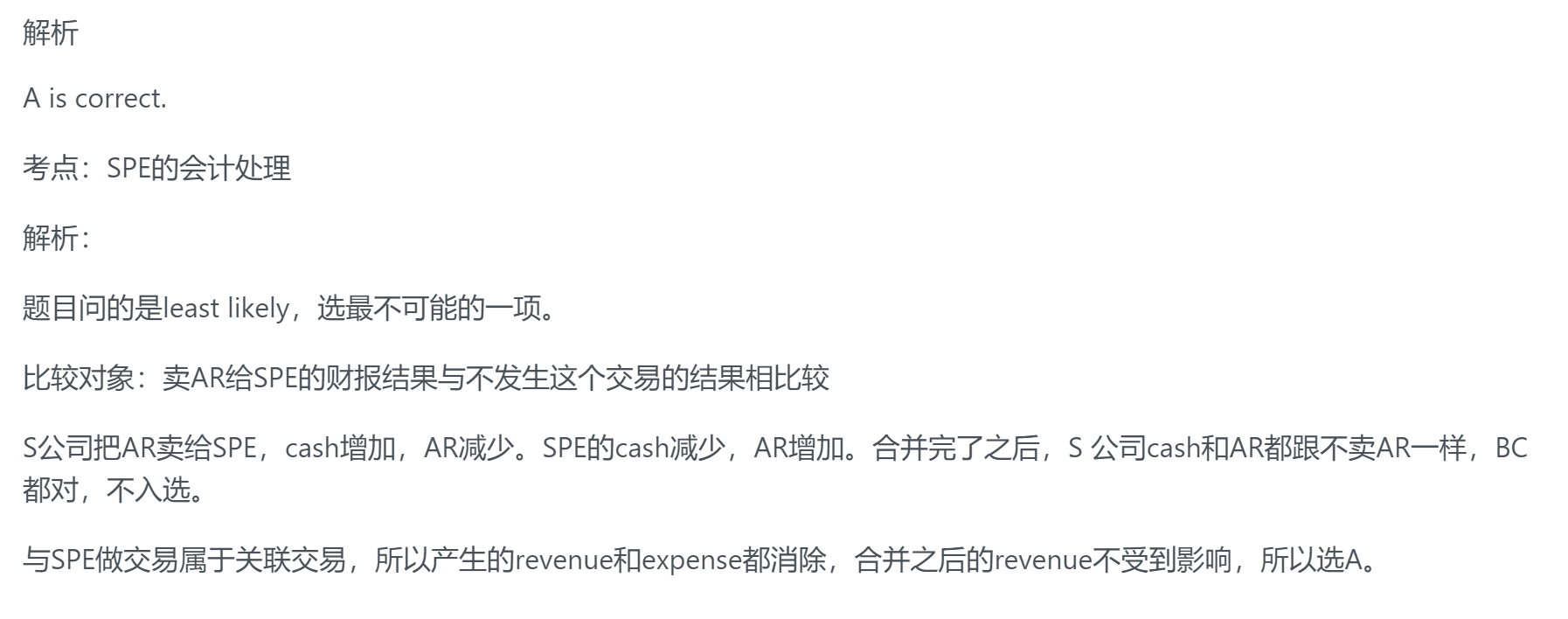

If Alfa sells its receivable to the SPE, its consolidated financial results will most likely show:

选项:

A.

a higher revenue for 2012

B.

the same cash balance for 2012

C.

the same accounts receivable balance for 2012

上面的解释就是说:

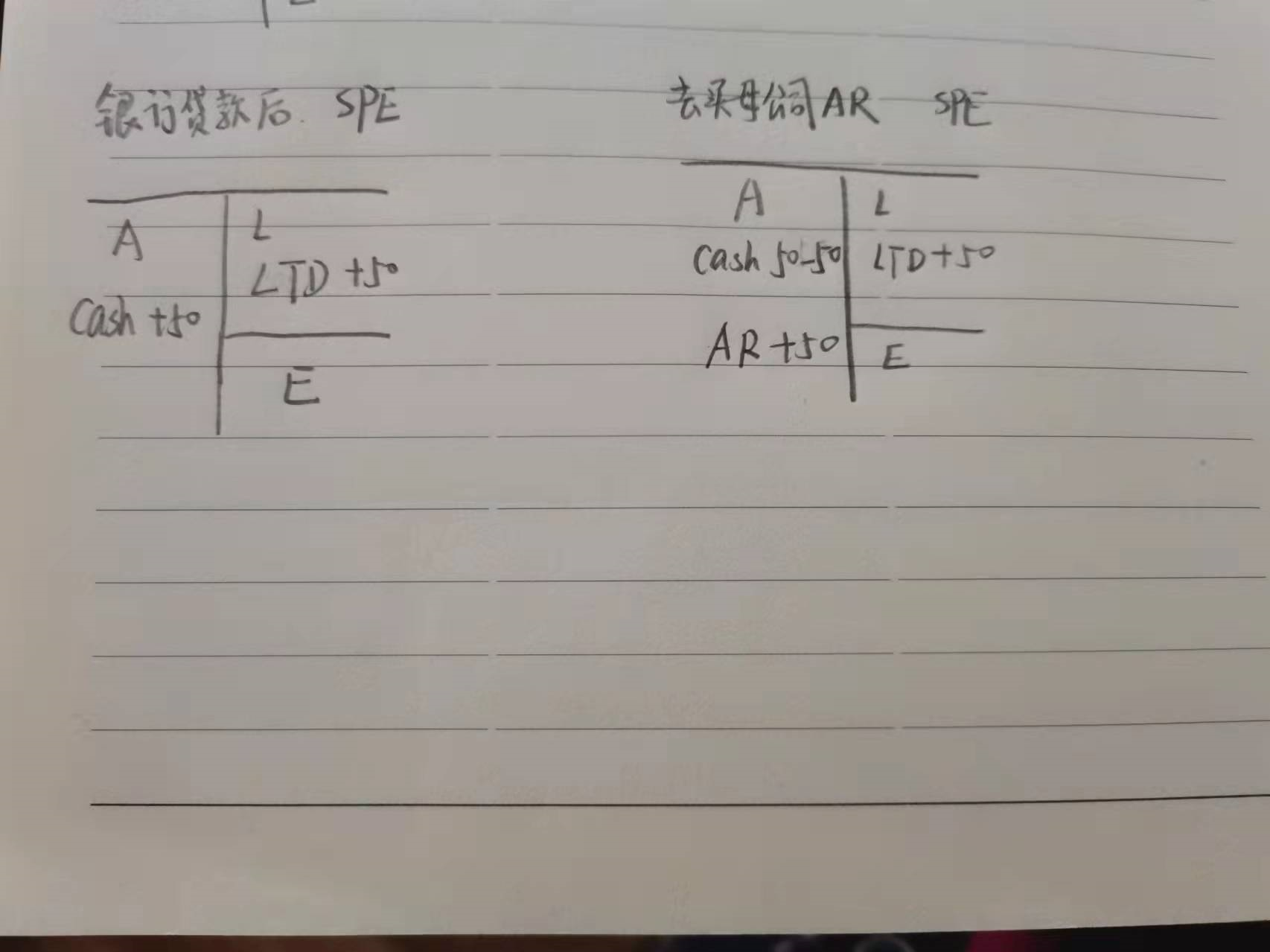

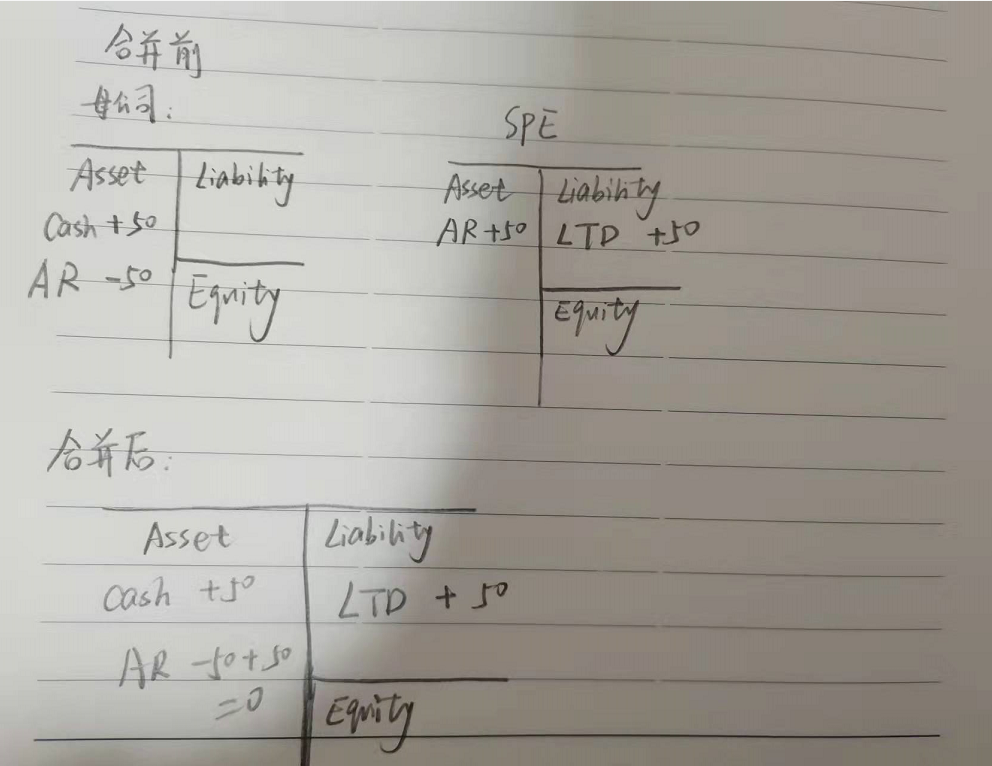

合并前:母公司的Cash增加一笔,AR减少一笔;同时SPE的cash减少一笔,AR增加一笔。这个解释好像不太对吧?如果是这样,合并后cash与AR一样,都会归零。

助教在其它的回答中说到:

我觉得上面这个解答才对,即:

合并前:母公司的Cash增加一笔,AR减少一笔;同时SPE的AR增加一笔,liability增加一笔,SPE的cash没有变化;

合并后:+AR-AR=0, 没有变化;cash不变,同时多了一笔liability。

烦请老师确认一下,谢谢。