NO.PZ2020021601000019

问题如下:

Judith Yoo is a financial sector analyst writing an industry report.

Part of Yoo’s analysis focuses on Company XYZ, a global commercial bank, and its CAMELS rating, risk management practices, and performance.

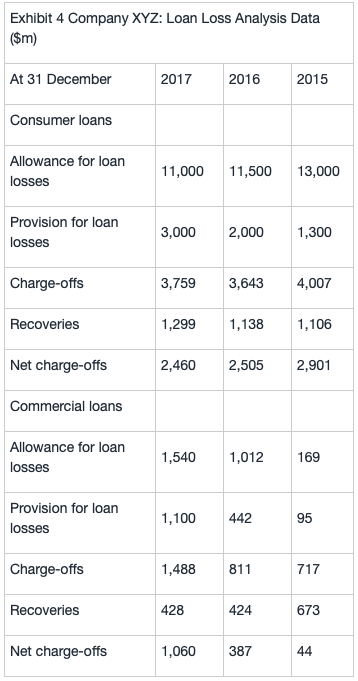

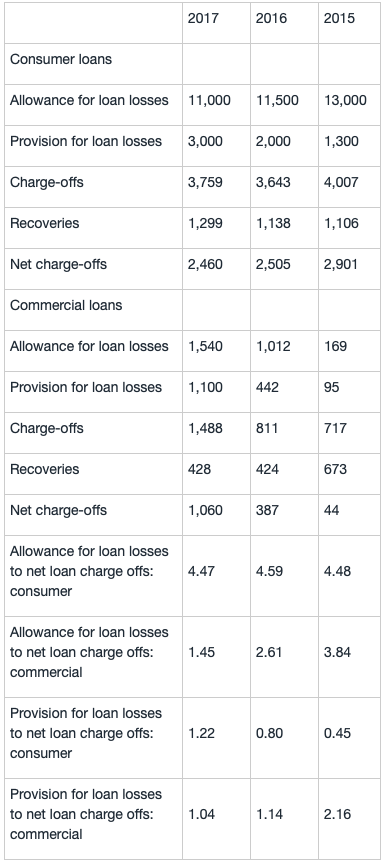

To assess Company XYZ’s risk management practices, Yoo reviews the loan loss analysis in Exhibit 4.

Based on Exhibit 4, a loan loss analysis for the last three years indicates that:

选项:

A.Company XYZ has become less conservative in its provisioning for consumer loans.

B.the provision for commercial loan losses has trailed the actual net charge- off experience.

C.the cushion between the allowance and the net commercial loan charge- offs has declined.

解释:

C is correct.

The allowance for loan losses to net commercial loan charge- offs has been declining during the last three years, which indicates that the cushion between the allowance and the net commercial loan charge- offs has deteriorated.

2015 Consumer: Allowance for Loan Losses/Net Loan Charge-Offs=13,000/2,901=4.48

2016 Consumer: Allowance for Loan Losses/Net Loan Charge-Offs=11,500/2,505=4.59

2017 Consumer: Allowance for Loan Losses/Net Loan Charge-Offs=11,000/2,460=4.47

2015 Commercial: Allowance for Loan Losses/Net Loan Charge-Offs=169/44=3.84

2016 Commercial: Allowance for Loan Losses/Net Loan Charge-Offs=1,012/387=2.61

2017 Commercial: Allowance for Loan Losses/Net Loan Charge-Offs=1,540/1,060=1.45

2015 Consumer: Provision for Loan Losses/Net Loan Charge-Offs=1,300/2,901=0.45

2016 Consumer: Provision for Loan Losses/Net Loan Charge-Offs=2,000/2,505=0.80

2017 Consumer: Provision for Loan Losses/Net Loan Charge-Offs=3,000/2,460=1.22

2015 Commercial: Provision for Loan Losses/Net Loan Charge-Offs=95/44=2.16

2016 Commercial: Provision for Loan Losses/Net Loan Charge-Offs=442/387=1.14

2017 Commercial: Provision for Loan Losses/Net Loan Charge-Offs=1,100/1,060=1.04

请问A和B为什么不对?