NO.PZ2018122701000045

问题如下:

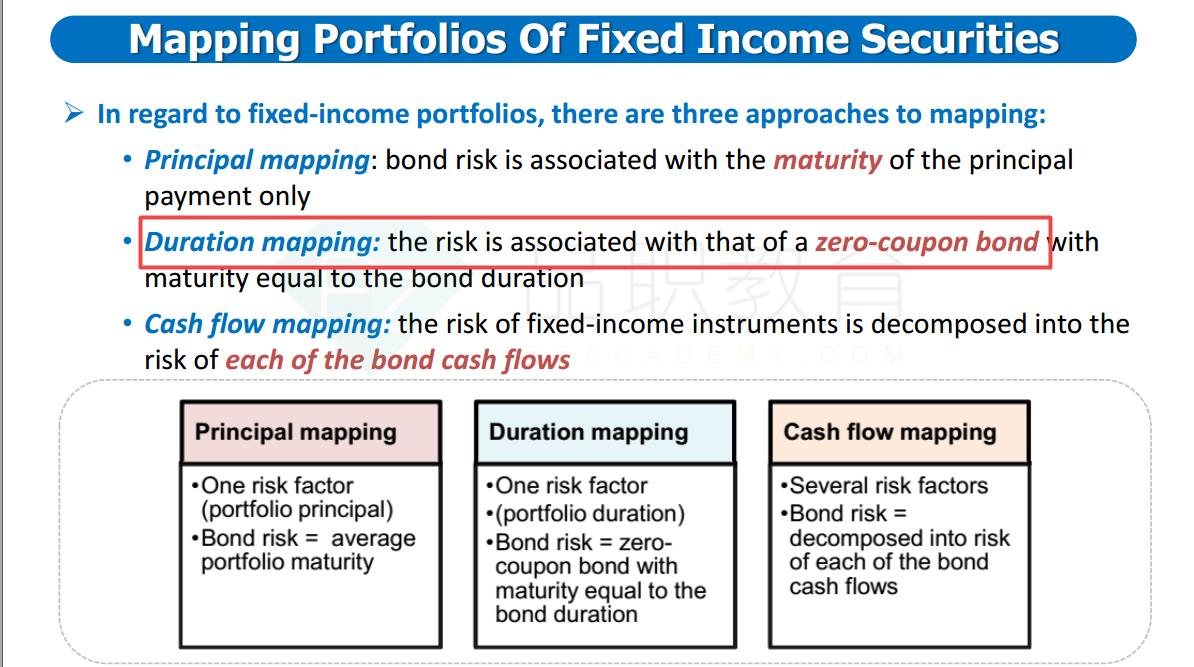

Which of these statements regarding risk factor mapping approaches is/are correct?

I.Under the cash flow mapping approach, only the risk associated with the average maturity of a fixed-income portfolio is mapped.

II.Cash flow mapping is the least precise method of risk mapping for a fixed-income portfolio.

III.Under the duration mapping approach, the risk of a bond is mapped to a zero-coupon bond of the same duration.

IV.Using more risk factors generally leads to better risk measurement but also requires more time to be devoted to the modeling process and risk computation.

选项:

A. I and II

B. I, III, and IV

C. III and IV

D. IV only

解释:

C is correct.

考点Mapping to Fixed Income Portfolios

解析Under the cash flow mapping approach, each payment (and not only the last one) is associated with a different risk factor, so statement I. is incorrect. Statement II.is incorrect because the CF mapping approach is more correct than duration or maturity mapping.

选项3为什么是正确的?怎么理解呢?