NO.PZ2020033003000067

问题如下:

Jane is asked to calculate the risk-neutral and real-world default probabilities of the bond A. She collected the following datas. The market price of the bond A with a face value of 100 is 95. The liquidity premium and credit risk premium are 2% and 1% respectively. The coupon rate of newly issued treasury bond is 2.5%. The expected inflation is 0.8%.

选项:

解释:

B is correct.

考点:Infer Credit Risk from Corporate Bond Prices

解析:risk-neutral default probability 100-95=5%

risk-neutral probability = real-world probability + credit risk premium + liquidity premium

real-world probability = 5% - 2%-1% = 2%

- 是不是少条件呀,我只能通过real world < calculated 安排出来BC 然后LGD没说是多少呀(看之前的解析 我就假设LGD = 100%吧)

- 看了 李坏_品职助教 的解答,有这么几个问题

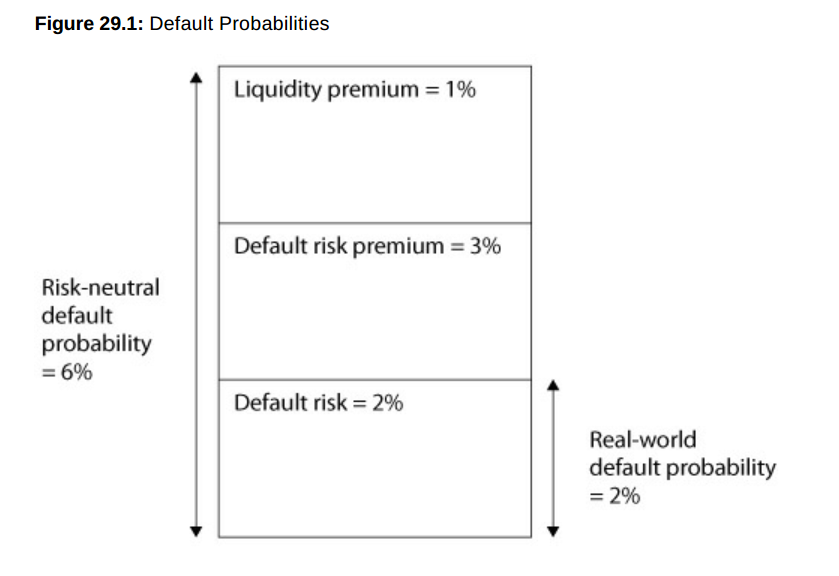

- Figure29.1 不懂为什么有了一个default risk 还有一个default risk premium,就像这道题一样 要我们求default probability,但还告诉我们一个credit premium?【我其实就是不太懂 risk-neutral违约概率=real-world违约率+default risk Premium + liquidity premium这个公式?好像老师上课没讲呀 这里提到的notes又是哪本书嘞?】

- 为啥这道题不考虑treasury呢?我的点在于:

- 看见expected inflation我感觉要走补偿的那个路子 就 rf+通胀补偿+liquidity补偿+credit补偿 = YTM 然后这个就可以和那个简化的式子结合起来了 就是苦于没有LGD而已。。。

希望我问的可以understandable hhh(蟹蟹蟹蟹~)