NO.PZ2018101501000013

问题如下:

Company M is investing $150 in a project which will be depreciated straight-line to zero over two years. The project will generate earnings before interest and taxes of $75 annually. The weighted average cost of capital of the company and required rate of return of the project are both 10%. The company is in the 25% tax bracket. What’s the economic income in the second year?

选项:

A.$11.93

B.$17.56

C.$22.78

解释:

A is correct.

考点:Other Valuation Models

解析:

首先,计算期间现金流 OCF:OCF = (S–C–D)(1–T)+D = EBIT*(1-T)+D = 75(1–0.25)+75 = 131.25

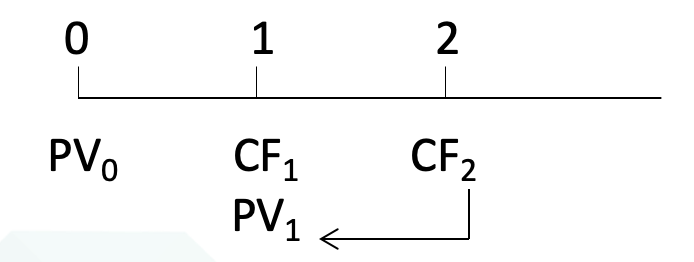

其次,根据公式 EI2 = CF2 + (PV2 - PV1),计算 PV1 = =119.32 PV2 = 0

所以,EI2 = 131.25 + (0 - 119.32) = $11.93

为什么pv2=0?

为什么是用OCF去除以r来得到market value的?不是应该拿资产的价格吗?也就是初始投资的价格?