NO.PZ2019052001000042

问题如下:

The RAROC indicator is more economically meaningful than the Sharp indicator. Analyst Williams is calculating the RAROC of a commercial loan portfolio for Company Q. He currently collects the following information: The principal amount is $1.3 billion. The pre-tax expected return on loan portfolio is 7%. In every year, the direct annual operating cost is expected to be $6 million. The loan portfolio is funded by $1.3 billion of retail deposits and the interest rate is 5%. Williams also expects that the expected loss on the portfolio is 0.3% of principal every year. In addition, to be cautious, Williams estimates the unexpected loss of the principal amount is up to 8%. In addition, Williams assumes that the risk-free rate is 1.5% and the effective tax rate is 25%. At last, Williams assumes that there is no transfer pricing issues. According to the definition of RAROC, what would Williams estimate about RAROC?

选项:

A.10.01%

B.12.74%.

C.12.72%.

D.18.35%.

解释:

B is correct.

考点:RAROC计算

解析:首先计算Unexpected loss= $1.3billion * 8% = $104 million. 所以return on economic capital = $104million * 1.5% = $1.56 million.

并且,expected revenues = $1.3billion* 7% = $91million.

利率费用interest expense = 0.05 x $1.3 billion = $65 million. expected losses = 0.003 x $1.3 billion = $3.9 million.

RAROC = (expected revenues - expected losses - taxes + return on economic capital +/- tansfers) / economic capital = (91-6-3.9-65+1.56+0) * (1-0.25) / 104 = 12.74%

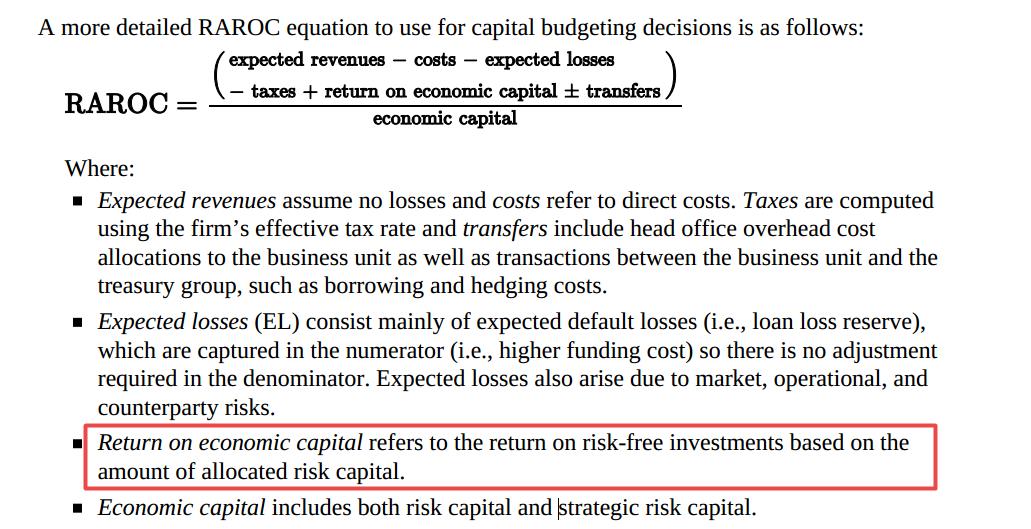

请问为什么return on economic capital = $104million * 1.5% = $1.56 million这样计算