NO.PZ2016012101000163

问题如下:

An analyst in the finance department of BOOLDO S.A., a French corporation, is computing the amortization of a customer list, an intangible asset, for the fiscal year ended 31 December 2009. She gathers the following information about the asset:

If the analyst uses the straight-line method, the amount of accumulated amortization related to the customer list as of 31 December 2009 is closest to:

选项:

A.€600,000.

B.€1,200,000.

C.€1,533,333.

解释:

B is correct.

Using the straight-line method, accumulated amortization amounts to

Accumulated amortization = [(2,300,000 – 500,000)/3 years] × 2 years = 1,200,000.

解析:使用直线法计算无形资产的摊销费用。注意取得无形资产的时间是2008年1月日。题目让计算的是2009年12月31日的累积摊销金额,包括2008年度和2009年度共两年的摊销费用。

每年直线法摊销费用= (初始成本-残值)/预计使用年限=(2,300,000 – 500,000)/3 years=600,000

每年摊销费用是600,000,累积摊销金额即两个年度的总摊销费用为600,000*2=1,200,000

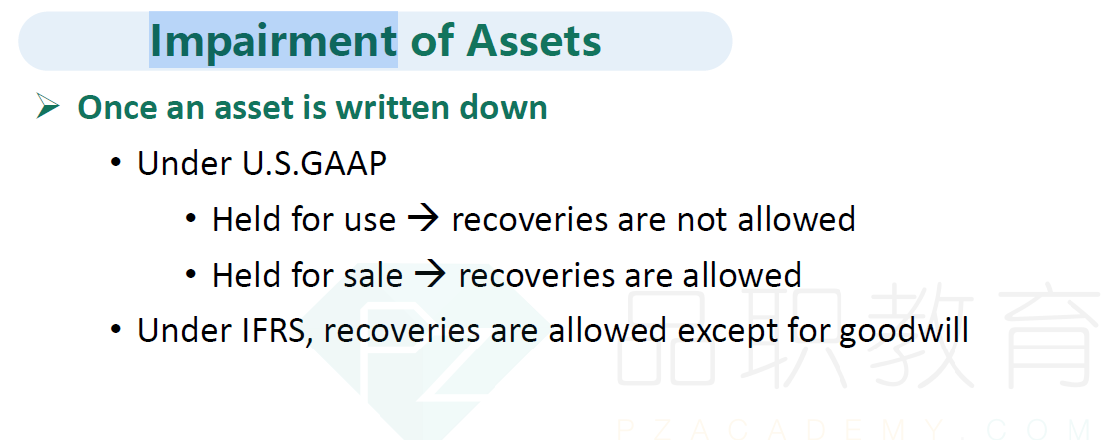

请问无形资产可以回转么?为什么不行?如果可以回转是国际准则和美国准则都可以回转嘛?