NO.PZ2016012102000060

问题如下:

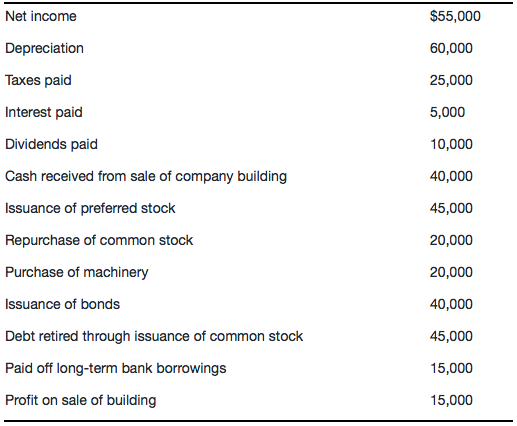

Under U.S. GAAP, cash flow from operations is:

选项:

A.$75,000.

B.$100,000.

C.$115,000.

解释:

B is correct.

CFO=Net income - profit on sale of building + depreciation = 55,000 - 15,000 + 60,000 = $100,000

The profit on the sale of the building should be subtracted from net income, and that taxes and interest are already deducted in calculating net income.

计算CFO有直接法和间接法两种方法。根据题目数据,可以判断应该用间接法计算。

从NI出发,需要调整:

①损益表中的Non-cash items和non-operating items

②资产负债表中net changes in working capital(AR、inventory、AP)

题目表格中的数据有损益表数据,有资产负债表的数据,也有现金流量表中的数据等,我们要从中挑选我们所需要的的调整项目。

Depreciation:non-cash item 属于调整项。

Tax paid、Interest received、Dividends received、Cash received from sale of company's equipment:现金流量表数据,不考虑。

其中,Cash received from sale of company’s equipment是出售设备收到的现金,属于CFI流入。

Issuance of preferred stock是发行优先股,收到的钱属于CFF流入,也不属于我们应该考虑的调整项。

Repurchase of common stock是公司用自己的钱回购自己发行的股票,属于CFF的流出,,也不属于我们应该考虑的调整项。

Purchase of machinery是买设备,属于CFI流出,也不属于我们应该考虑的调整项。

Issuance of bonds是发债券,属于CFF流入,也不属于我们应该考虑的调整项。

Debt retired through issuance of common stock是通过发行普通股筹集资金,用筹集的资金来偿还债务,类似于可转债转换为股票,这个活动并不会产生现金流的变化。不考虑。

Paid off long-term bank borrowings是还清银行贷款,属于CFF的流出。也不属于我们应该考虑的调整项。

Profit on sale of building是利润表的科目,

综上,我们应该考虑的调整项只有depreciation和Profit on sale of building。

CFO=Net income - profit on sale of building + depreciation = 55,000 - 15,000 + 60,000 = $100,000

Why " the Cash received from sale the company building 40,000" dont need to be deducted from NI, this is similar to profit to sale the building which is the gain of disposal, right?