NO.PZ2016082402000006

问题如下:

A portfolio manager has a bond position worth USD 100 million. The position has a modified duration of eight years and a convexity of 150 years. Assume that the term structure is flat. By how much does the value of the position change if interest rates increase by 25 basis points?

选项:

A. USD

-2,046,875

B. USD

-2,187,500

C. USD

-1,953,125

D. USD

-1,906,250

解释:

ANSWER: C

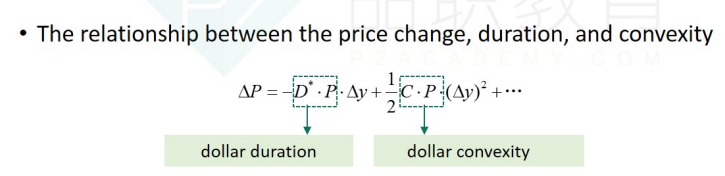

The change in price is given by

用的2021年教材;没找到公式啊!公式在教材哪页?