NO.PZ2018103102000092

问题如下:

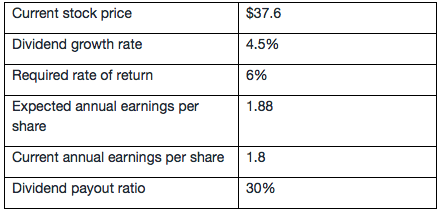

Matt wants to use the Gordon growth model to find a justified leading P/E for the Company M. He has assembled the information in the given table.

Based on the justified leading P/E and the actual leadingP/E, determine whether the stock is fairly valued, overvalued, or undervalued?

选项:

A.Overvalued.

B.Fairly valued.

C.Undervalued.

解释:

B is correct.

考点:Gordon Growth Model

解析:

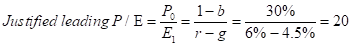

Actual leading P/E = 37.6/1.88 = 20

两者相等,所以股票被正确定价。

在做题的时候,联系实际,有点想不明白,这个required rate of return,比如说在看一个上市公司数据的时候,是怎么算出来的?是会直接在财报中给出,还是需要分析师自己计算?