NO.PZ201710200100000405

问题如下:

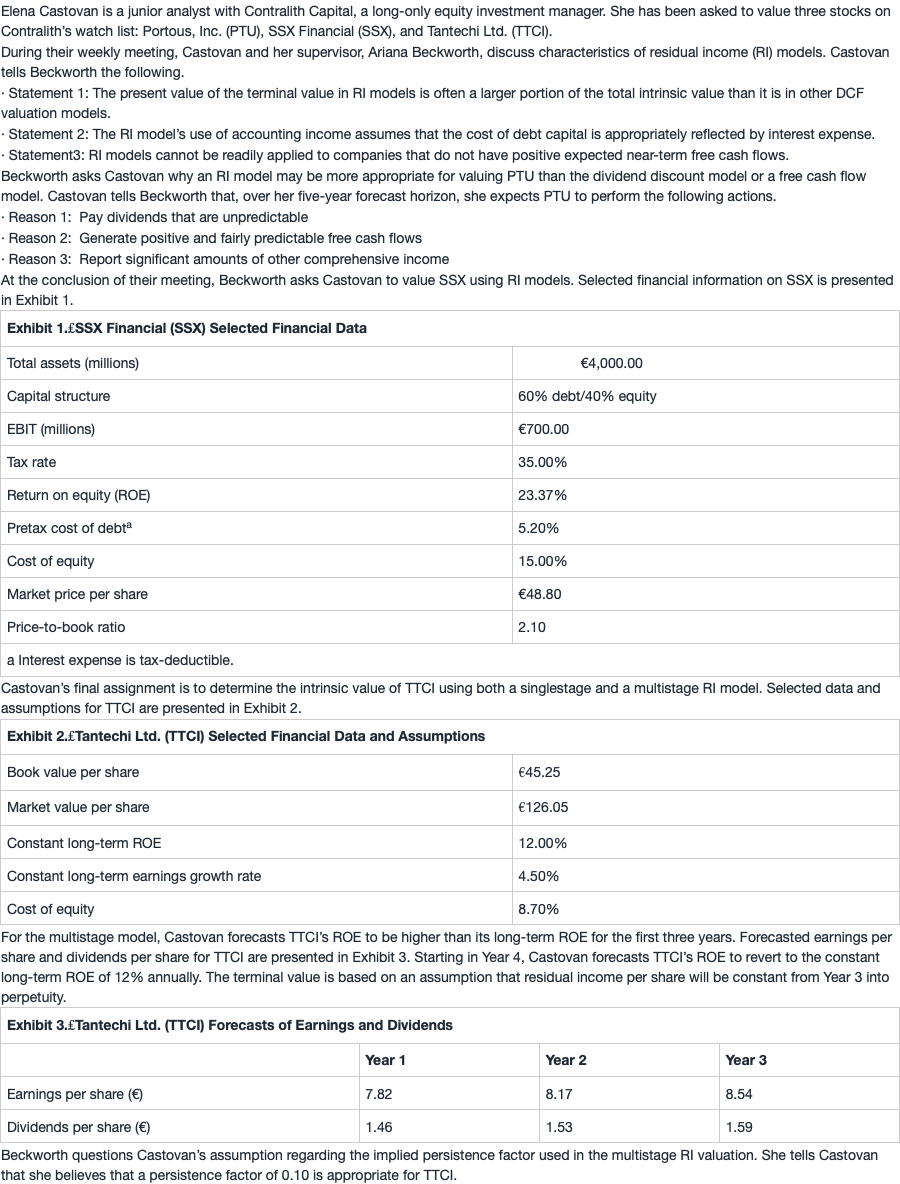

5. Based on Exhibit 1 and the single-stage residual income model, the implied growth rate of earnings for SSX is closest to:

选项:

A.5.8%.

B.7.4%.

C.11.0%.

解释:

B is correct.

The implied growth rate of earnings from the single-stage RI model is calculated by solving for g in the following equation:

Book value per share can be calculated using the given price-to-book ratio and market price per share as follows.

Book value per share (B0) = Market price per share/Price-to-book ratio

= €48.80/2.10 = €23.24

Then, solve for the implied growth rate

g = 7.4%

老师,为何这道题不能BV用4000*40%,然后V用上一题算出来的133.9带入公式计算g?