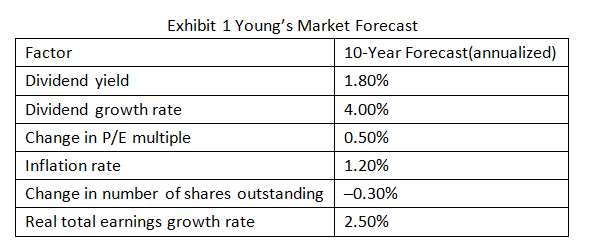

Conner Young is an economist at a multi-strategy asset management firm. Each year, he provides his firm with a report that includes a series of market forecasts. As part of his report, Young uses the Grinold-Kroner model to forecast the expected rate of return on equities for the next 10 years. He uses the data in Exhibit 1 to prepare his forecast.

Determine the following sources of return for equities, according to the Grinold-Kroner model, using Young’s forecasts:

Expected income return = expected dividend yield minus expected percentage change in number of shares outstanding = 1.80% – (–0.30%) = 2.10%

请问,都说了要用expected div yield,所以这里是不是应该是 1.8*1.4+0.3 =2.82。

expected div yield = D1/P = Div yield * (1+div growth rate )

是不是答案有误? 谢谢