NO.PZ2019103001000041

问题如下:

McLaughlin and Michaela Donaldson, a junior analyst at Delphi, are now discussing how to reposition the portfolio in light of McLaughlin’s expectations about interest rates over the next 12 months. She expects interest rate volatility to be high and the yield curve to experience an increase in the 2s/10s/30s butterfly spread, with the 30-year yield remaining unchanged. Selected yields on the Treasury yield curve, and McLaughlin’s expected changes in yields over the next 12 months, are presented in Exhibit 1.

Donaldson suggests they also consider altering the portfolio’s convexity to enhance expected return given McLaughlin’s interest rate expectations.

Given McLaughlin’s interest rate expectations over the next 12 months, one way that Donaldson and McLaughlin could alter convexity to enhance expected return would be to:

选项:

A.sell call options on bonds held in the portfolio.

buy call options on long-maturity government bond futures.

sell put options on bonds they would be willing to own in the portfolio.

解释:

B is correct.

McLaughlin expects interest rate volatility to be high and the yield curve to experience an increase in the butterfly spread, with the 30-year yield remaining unchanged. To increase the portfolio’s expected return, Donaldson and McLaughlin should buy call options on long-maturity government bond futures to increase convexity.

“因为题干预测的利率信息是利率波动加大:

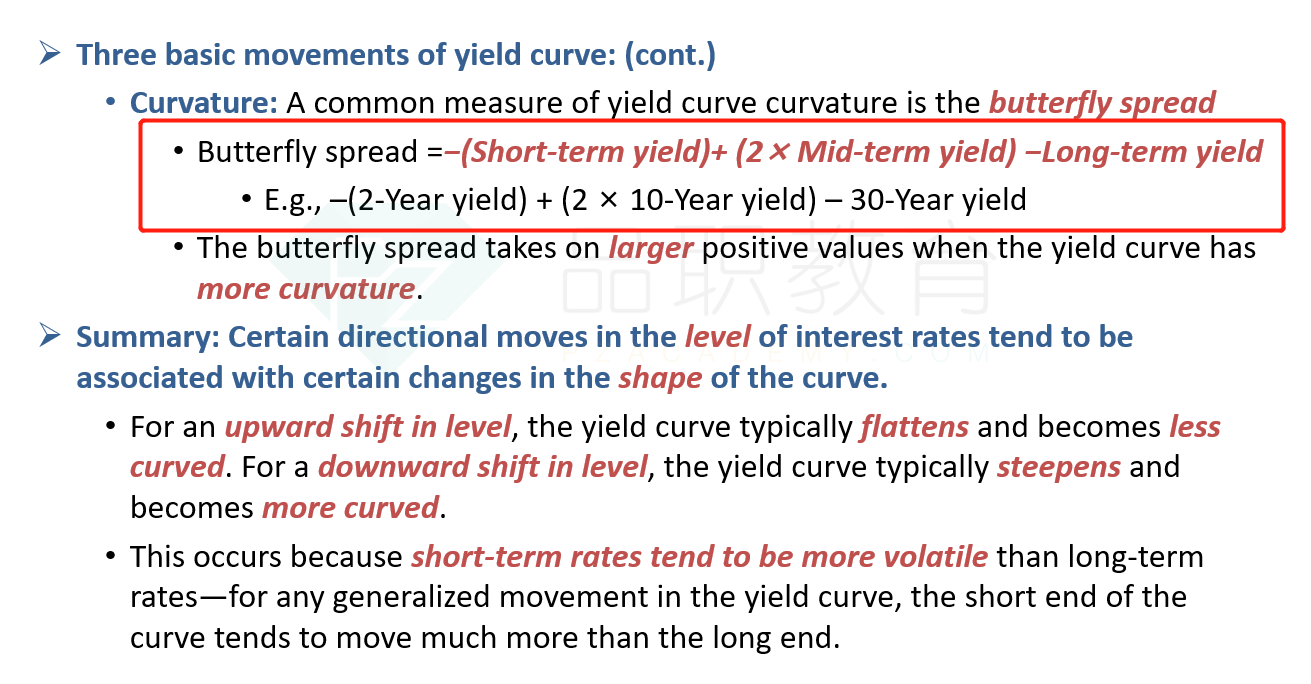

She expects interest rate volatility to be high and the yield curve to experience an increase in the 2s/10s/30s butterfly spread, with the 30-year yield remaining unchanged

所以B说的Buy options,就会增加组合的Convexity,于是组合获得“涨多跌少”的优势,策略会增强收益。”

怎么理解increase in the 2s/10s/30s butterfly spread?spread增加利率增加,债券价格下跌幅度再有限,但那也是跌啊哪来的enhance return?为啥不能直接卖了option赚期权费 收益的更多?