NO.PZ2020033001000031

问题如下:

Alextrasza Bank entered the one-year correlation swap contract as a fixed correlation receiver. The nominal principal of the contract is 100 million. If the two assets of the target three assets have a daily correlation of 0.5, 0.5, 0.3. How much will Alextrasza Bank receive at maturity if the fixed correlation rate is 0.2?

选项:

A. $43,000,000.

B. $23,000,000.

C. -$23,000,000.

D. -$43,000,000.

解释:

C is correct.

考点:平均相关性计算

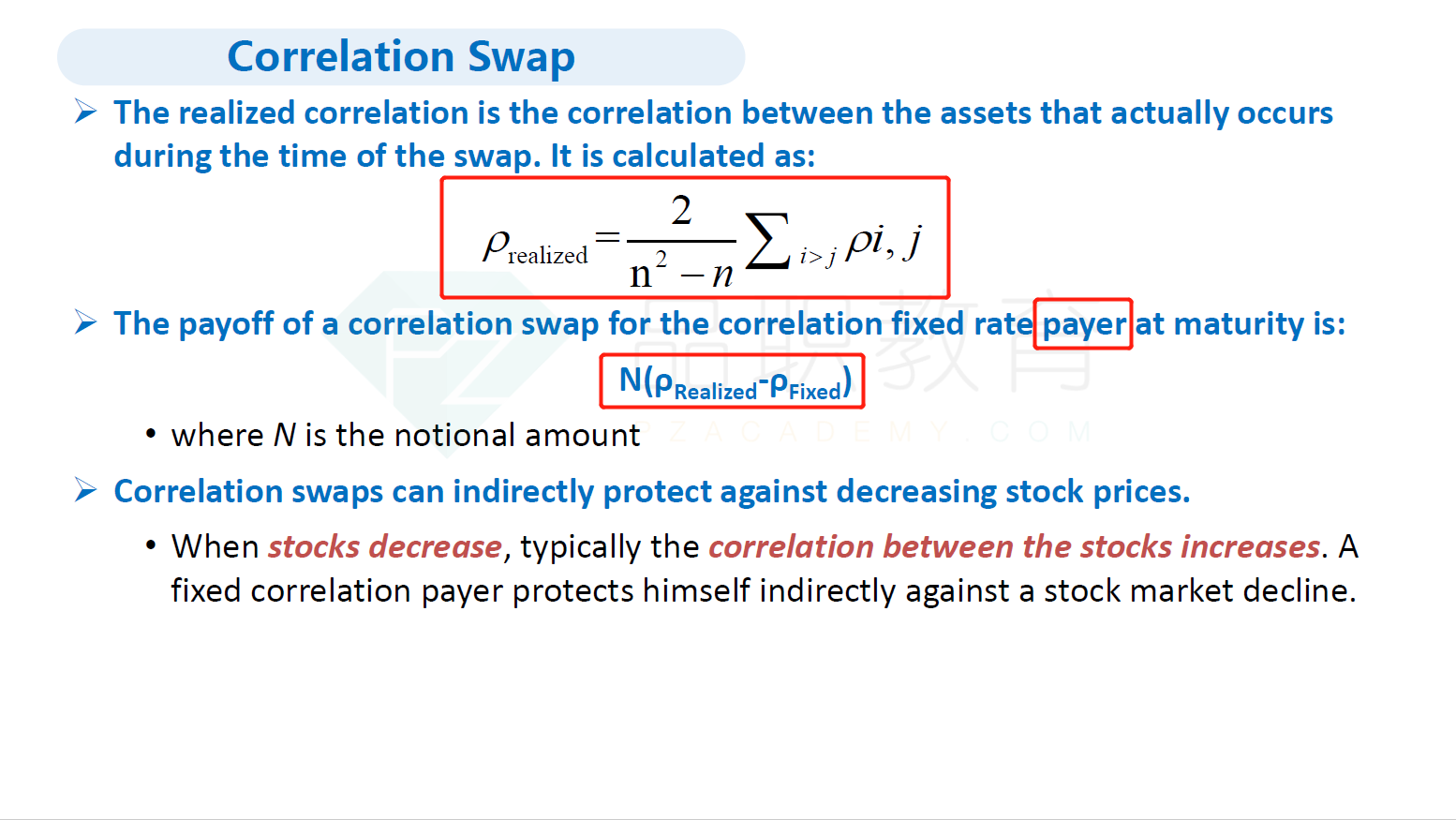

解析: 计算公式如下ρrealized =2/(32 -3)*(0.5+0.5+0.3)=0.43

$100,000,000*(0.2-0.43)=-$23,000,000

这道题是哪个公式啊,能否讲解解题全过程 ,没看懂