NO.PZ2018122701000091

问题如下:

A risk manager is examining a firm’s equity index option price assumptions. The observed volatility skew for a particular equity index slopes downward to the right. Compared to the lognormal distribution, the distribution of option prices on this index implied by the Black-Scholes-Merton (BSM) model would have:

选项:

A. A fat left tail and a thin right tail.

B. A fat left tail and a fat right tail.

C. A thin left tail and a fat right tail.

D. A thin left tail and a thin right tail.

解释:

A is correct.

考点Volatility Smile

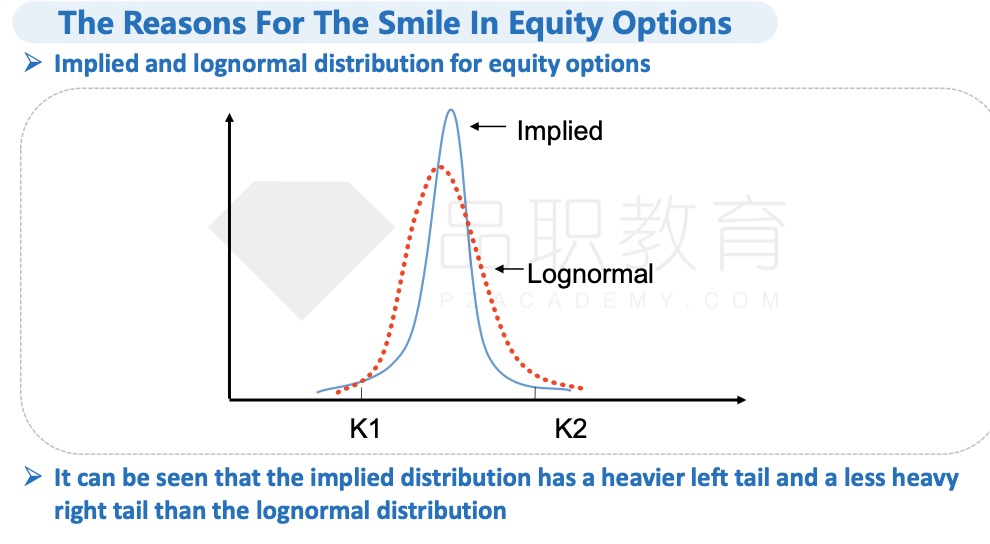

解析A downward sloping volatility skew indicates that out of the money puts are more expensive than predicted by the Black-Scholes-Merton model and out of the money calls are cheaper than expected predicted by the Black-Scholes-Merton model. The implied distribution has fat left tails and thin right tails.

没有对应上,请老师指导!