NO.PZ2016082405000052

问题如下:

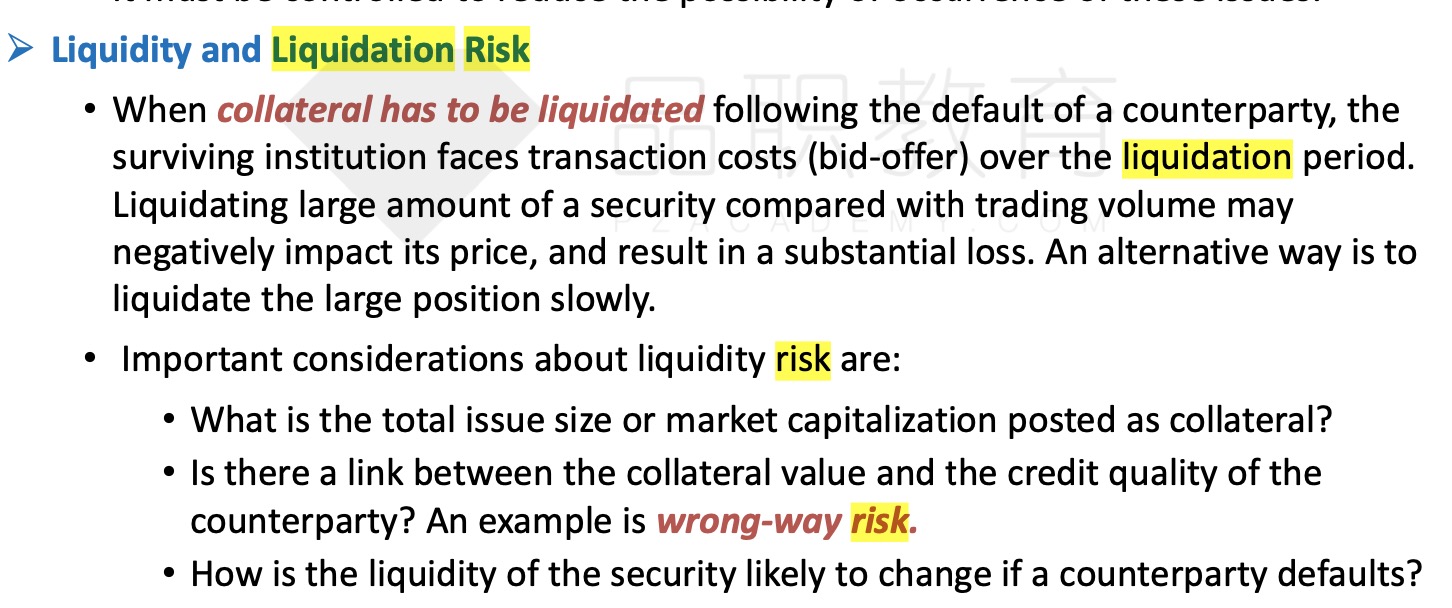

Collateral agreements could potentially create multiple risks, including liquidity and liquidation risks. Which of the following is most accurate regarding liquidity and liquidation risk?

选项: A. Liquidation risk occurs when the

amount of a security sold is large relative to its outstanding volume, which may

affect the price of that security.

B. Liquidity risk must be hedged in spot

and forward markets.

C. Liquidation risk embodies a

transaction cost when collateral is liquidated in accordance with an

independent amount.

D. Liquidity risk occurs when there are

potential pitfalls in the handling of collateral, including human error.

解释:

A Liquidating a security in an amount that is large relative to its typical trading volume may negatively impact its price, leading to a substantial loss.

请问老师,这两个概念具体是在哪里讲的?