NO.PZ2015120204000044

问题如下:

After applying data transformations, Steele scales the financial data using normalization. She notes that over the full sample dataset, the “Interest Expense” variable ranges from a minimum of 0.2 and a maximum of 12.2, with a mean of 1.1 and a standard deviation of 0.4.

Exhibit 1 Sample of Raw Structured Data Before Cleansing

Based on Exhibit 1, for the firm with ID #3, Steele should compute the scaled value for the “Interest Expense” variable as:

选项:

A.0.008.

0.083.

0.250.

解释:

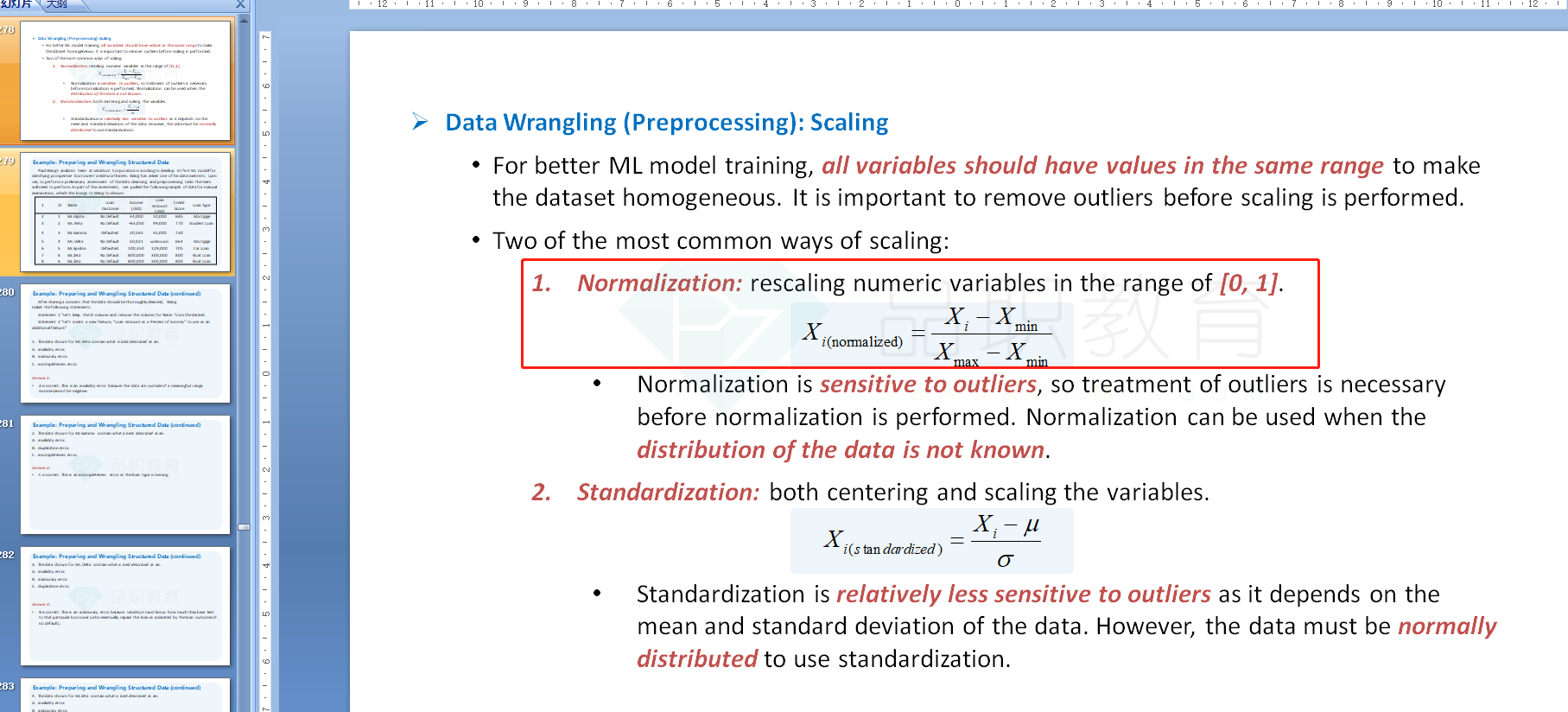

B is correct. Steele uses normalization to scale the financial data. Normalization is the process of rescaling numeric variables in the range of [0, 1]. To normalize variable X, the minimum value (Xmin) is subtracted from each observation

(Xi), and then this value is divided by the difference between the maximum and minimum values of X (Xmax – Xmin):

The firm with ID #3 has an interest expense of 1.2. So, its normalized value is calculated as:

Xi(normalized) =(1.2-0.2)/(12.2-0.2)=0.083

这个知识点没有找到,请问一下在讲义的哪个位置