NO.PZ201909300100000204

问题如下:

4 Based on Exhibit 1, the capture ratios of the portfolio indicate:

选项:

A.a concave return profile.

positive asymmetry of returns.

that the portfolio generates higher returns than the benchmark during all market conditions.

解释:

B is correct.

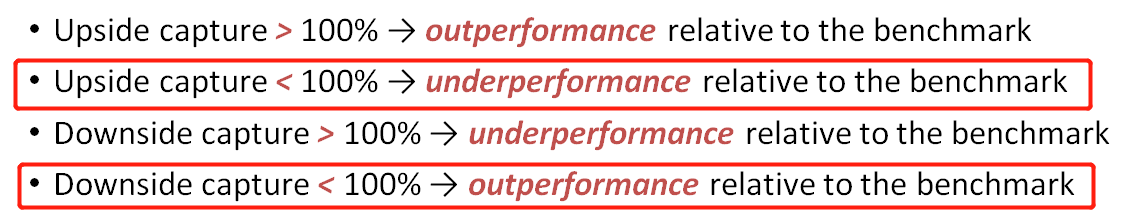

The upside/downside capture, or simply the capture ratio (CR), is the upside capture ratio divided by the downside capture ratio.

(Upside capture)/(Downside capture) = 0.66/0.50 = 1.32.

A capture ratio greater than 1 indicates positive asymmetry of returns, or a convex return profile.

请问c怎么理解,涨多跌少的话return确实比benchmark高,是因为题目说的all market condition太绝对了吗?