问题如下:

6. Using the data in Exhibit 3, Withers can estimate the sustainable growth of the Wakuni Corporation as being closest to:

选项:

A. 10.66%.

B. 11.04%.

C. 14.05%.

解释:

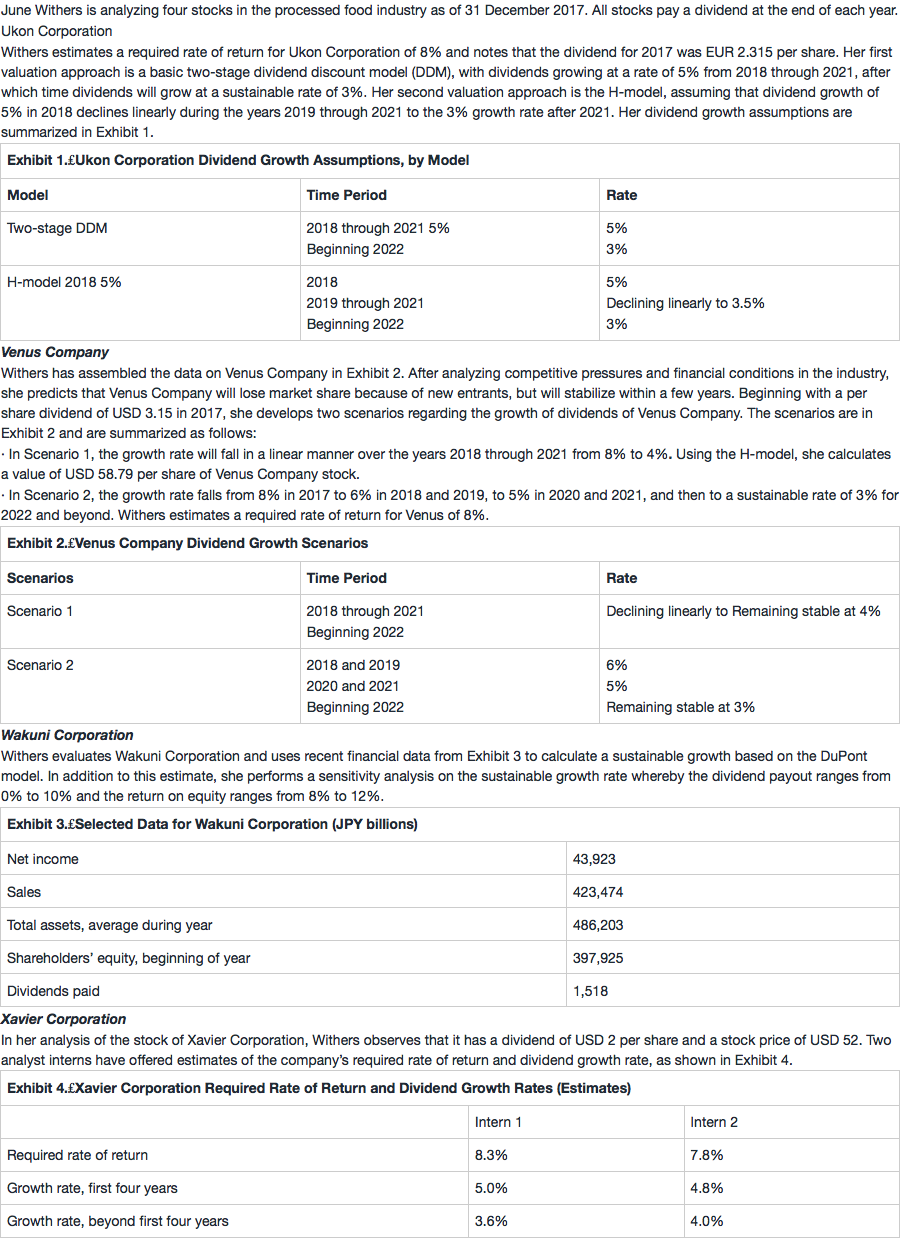

A is correct, based on the use of average total assets and beginning-of-year

shareholders’ equity

To calculate sustainable growth,

老师 看了其他答案还是不懂为什么ROE的计算不用期初和期末的平均值、不应该要跟NI对应吗?谢谢