问题如下:

5. Based on Exhibit 2, Troubadour should find that an arbitrage opportunity relating to TSI shares is

选项:

A.not available.

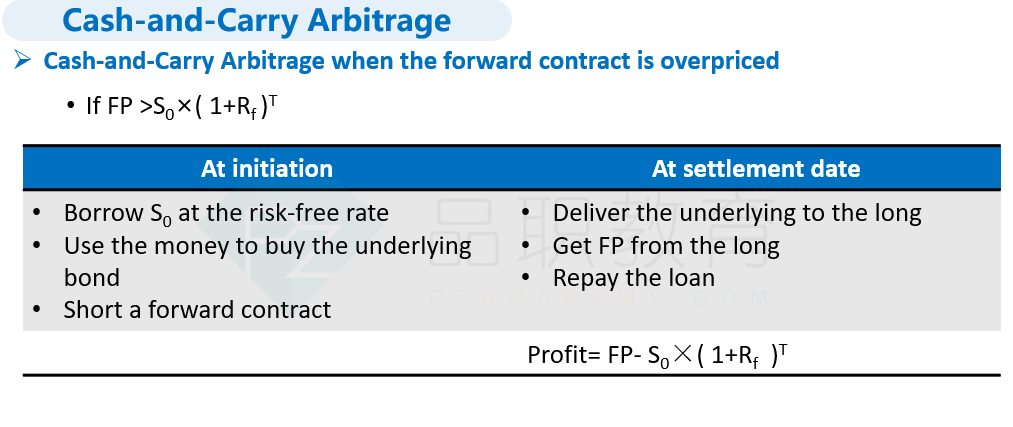

B.available based on carry arbitrage.

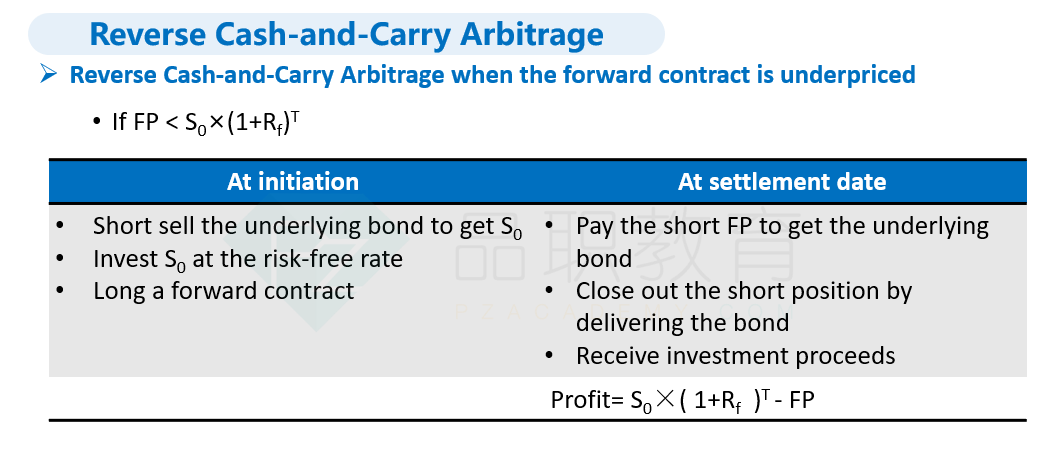

C.available based on reverse carry arbitrage.

解释:

A is correct.

The carry arbitrage model price of the forward contract is FV(S0) = S0(1 + r)T= $250(1 + 0.003)0.75 = $250.562289.

The market price of the TSI forward contract is $250.562289. A carry or reverse carry arbitrage opportunity does not exist because the market price of the forward contract is equal to the carry arbitrage model price.

请问讲义上哪里有reverse carry trade这个内容?